Helping Borrowers Understand Beats Chasing the Lowest Rate

The explosion and proliferation of mortgage tools, tips and resources has empowered (and overwhelmed) modern homebuyers more than at any point in our country’s history. Interest rates, monetary and economic policies and tariff chatter dominates the headlines, TikToks, and the inboxes of every prospective borrower. But when it comes to decision-making, what buyers actually need is not another rate quote. What they truly need are tools that clearly demonstrate the VALUE of buying now vs. waiting for later.

As Shawn Brown, CEO of Mortgage Maker AI, demonstrates in his Mortgage Maker AI client demos, the real value mortgage professionals offer today is not just quoting numbers. It’s simplifying the complex. It’s giving borrowers a clear understanding of what their choices actually mean including financially, emotionally, and long term.

The Problem: Borrowers Are Drowning in (Ugh) Rate Noise

Unless you have recently been in the hunt for a house, the following may not sound familiar. The simple fact is that modern borrowers are inundated with rate comparisons, APRs, and opinion pieces. But what they’re not getting is context. A quote means nothing if the borrower doesn’t understand how it aligns with their goals.

Loan officers are on the front lines of this confusion. Many feel the pressure to win business by “having the best rate” instead of leading with education and insight. That’s where most mortgage presentation software platforms fall short. Take stock of the one you currently use…does this sound familiar?

Legacy Mortgage Tools Confuse More Than They Clarify

Most legacy mortgage presentation platforms were built for an earlier era when they could afford to require steep learning curves and the burden of building complicated workflows. They’re clunky, overly technical, and require multiple screens or full report regenerations just to compare small loan variations. Even worse, many borrower-facing outputs carry the software’s own branding instead of the loan officer’s. In other words, when presenting loan options and scenarios to a home buyer, why would you want another brand name plastered all over your reports. Wouldn’t it be more beneficial if your brand name appeared in the reporting and dashboards to help you expand your own footprint?

These legacy mortgage presentation software systems may work for enterprise teams with training departments, but for most independent brokers and loan officers, they create friction. They delay conversations, reduce trust, and often confuse borrowers rather than enlighten them. Not exactly ideal when attempting to meet and exceed the wants, needs, and demands of modern home buyers.

Demonstrating Value: What Home Borrowers Actually Want

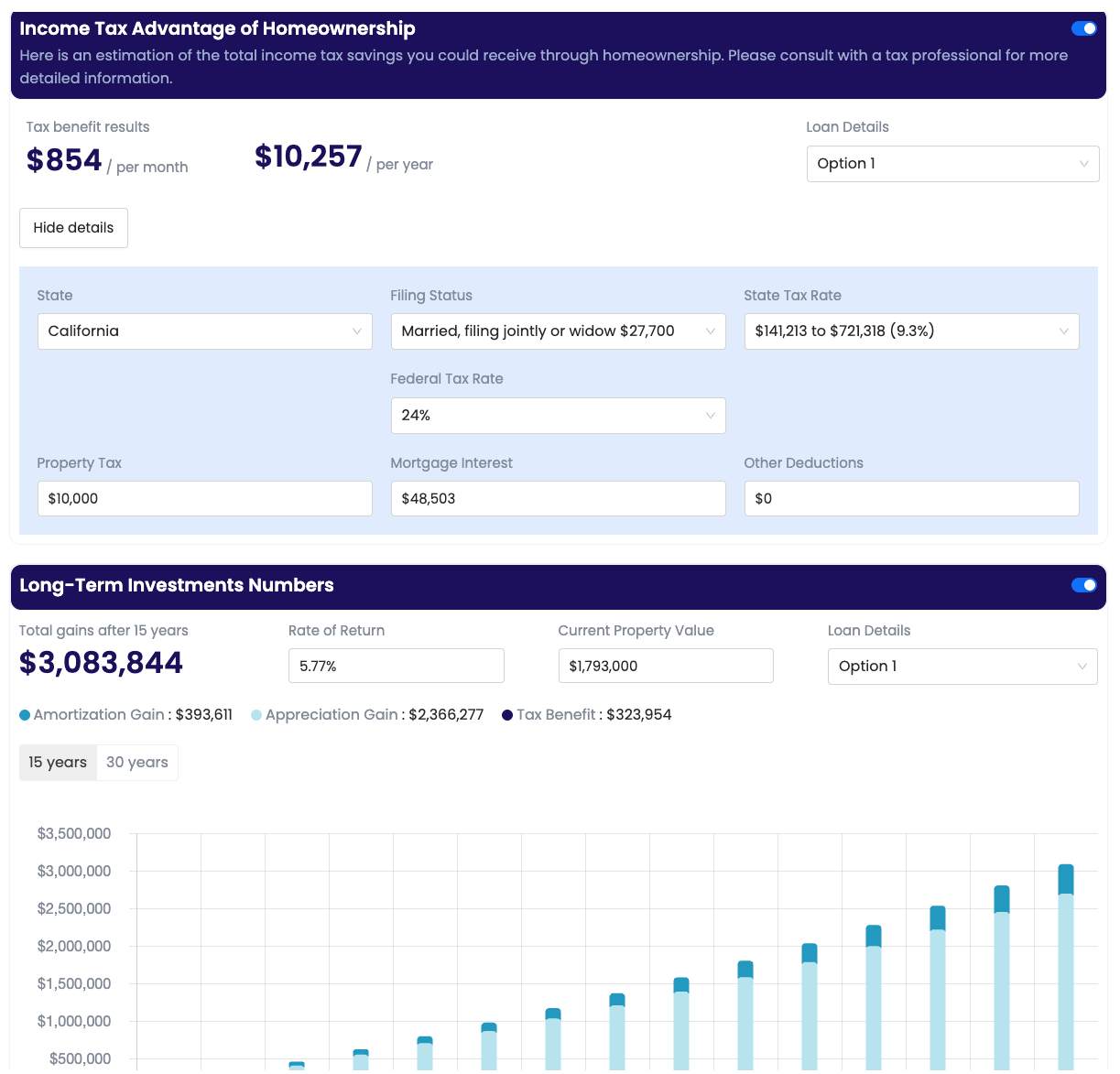

In his Mortgage Maker AI demos, CEO/Founder Shawn Brown repeatedly returns to one simple concept: value. Not just financial value, but the value of being understood, the satisfaction that comes with seeing the lightbulb light up over a future home buyer’s head. When a borrower can clearly see the difference between loan options, projected long-term savings, and tax advantages — without flipping through five different PDFs — you gain more than a signature. You gain trust. And we all know that trust is widely considered the holy grail of mortgage lending.

Modern buyers want to make confident, informed choices. That doesn’t come from quoting the lowest rate. It comes from showing what that rate means over five years, ten years, or the life of the loan. It comes from visuals that explain, not overwhelm. And it comes from software that lets the loan officer be the hero of the presentation, not the platform.

How Mortgage Maker AI Breaks the Mold

Mortgage Maker AI was designed by working mortgage professionals who understood what the industry was missing, rolled up their sleeves and set course to design a smarter, more intuitive mortgage presentation software built for real client conversations.

Here’s what sets Mortgage Maker apart from legacy mortgage presentation software SaaS platforms such as Mortgage Coach and MBS Highway:

- Toggle feature: Instantly switch between purchase, refi, rate scenarios, and loan terms without generating a new report.

- White-label branding: Every report can feature the loan officer or company’s brand, not Mortgage Maker AI.

- Clear visuals: Borrowers can easily compare long-term cost, equity, and tax savings — no spreadsheet or calculator needed.

- Loom integration: Record personalized video walk-throughs to guide the client experience even when you’re not in the room.

Built for Loan Officers, Trusted by Borrowers

Loan officers using Mortgage Maker AI regularly report that prospects better understand their options, feel more confident making decisions, and convert faster without additional calls or hand-holding.

When your tools reflect professionalism and simplicity, your brand does too. #winning

The Bottom Line? Clarity Converts

As interest rates fluctuate and market conditions evolve, clarity will always win over chaos. Mortgage Maker AI helps loan officers get back to what they do best and are more conducive to closing deals – advising, guiding, and helping clients feel confident every step of the way.

If your current mortgage presentation software makes borrowers more confused than confident, it may be time to try something built for the modern mortgage professional. Ready to give it a try?