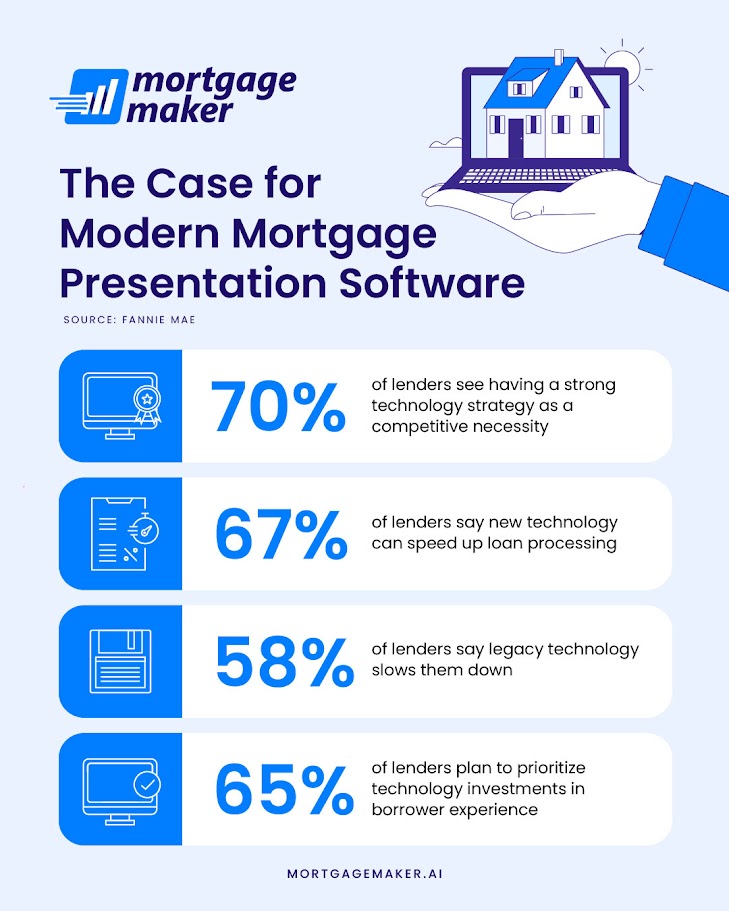

Recent survey data from Fannie Mae’s Q2 2025 Mortgage Lender Sentiment Survey makes one thing crystal clear: modern technology is no longer a “nice-to-have” for mortgage professionals but a business-critical asset. The report shows that:

- 72% of lenders list enhancing borrower experience as a top priority when adopting new tech.

- 68% say efficiency and reduced manual processes are key drivers for technology adoption.

- 60% identify outdated systems as a barrier to providing a modern borrower experience.

- Over half expect to increase investment in digital tools within the next year.

These findings validate what our team has believed from day one—modern, intuitive platforms like Mortgage Maker AI are exactly what today’s mortgage professionals need.

How Mortgage Maker Delivers on These Needs

Mortgage Maker’s AI-powered mortgage presentation software is built for speed, clarity, efficiency and borrower engagement. Our mortgage presentation SaaS platform allows loan officers to:

- Create professional presentations in minutes.

- Update scenarios in real time during client calls.

- Deliver mobile-friendly, borrower-friendly visuals.

- Work within a simple, intuitive interface that matches real-world workflows.

When market research from an organization as respected as Fannie Mae reinforces the need for modern tools, it’s a testament to the value Mortgage Maker delivers.

From Market Insight to Real-World Advantage

The mortgage industry is changing quickly. Borrowers now expect faster communication, clearer explanations, and the ability to review their options on any device. If your mortgage SaaS tools aren’t built to quickly pivot in real time to meet the shifting needs of modern homeowners, you are behind the times.

Mortgage Maker addresses these demands by combining powerful technology with user-friendly design, ensuring every interaction builds trust and moves the deal forward.

Experience Mortgage Maker for Yourself

There has never been a better time to explore how Mortgage Maker can fit seamlessly into your business. Our 30-day free trial lets you see firsthand how our mortgage presentation software can streamline your workflow, impress your clients, and help you close more deals.

Join the growing community of mortgage professionals who are trading outdated systems for tools built for today’s market.