At Mortgage Maker, our journey didn’t begin in a boardroom, it began with a single rubber band on the corner of a desk. Each new challenge, insight, and breakthrough added another band, symbolizing growth, innovation, and determination.

(Billed Annually)

This rubber band ball isn’t just a quirky keepsake—it’s a symbol of the grit, breakthroughs, and real-world experience behind Mortgage Maker AI. Late nights. Stacks of loan documents. Half-drunk coffees. We’ve lived it because we are mortgage professionals, building from firsthand frustration and hands-on experience.

Our team wasn’t backed by flashy VC funding or creating software from a boardroom. We were in the trenches, asking hard questions: Why can’t presentations update with live data? What if loan officers could deliver powerful educational insights instantly from a single screen? Every challenge we solved added another band to the ball—progress over perfection.

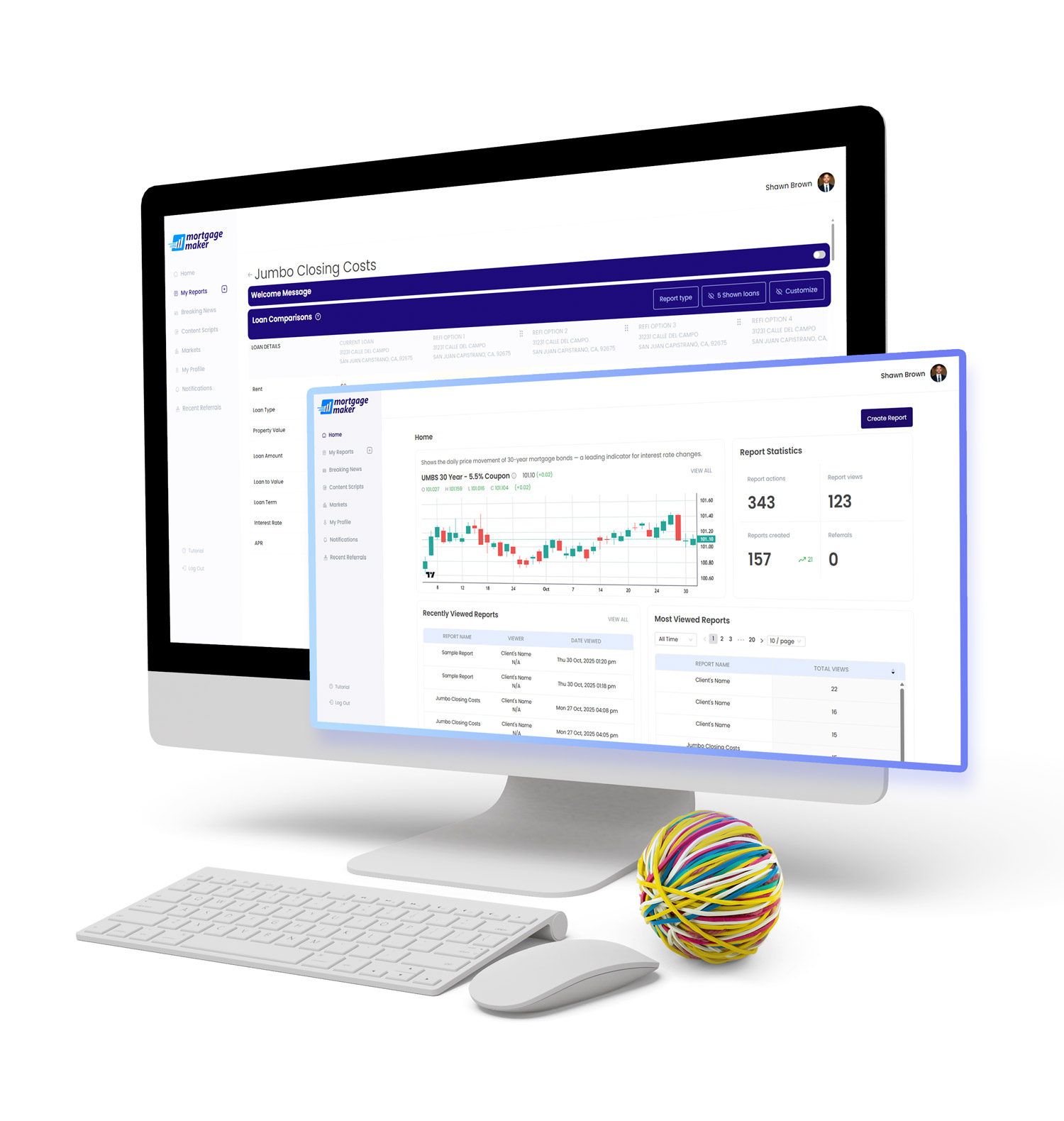

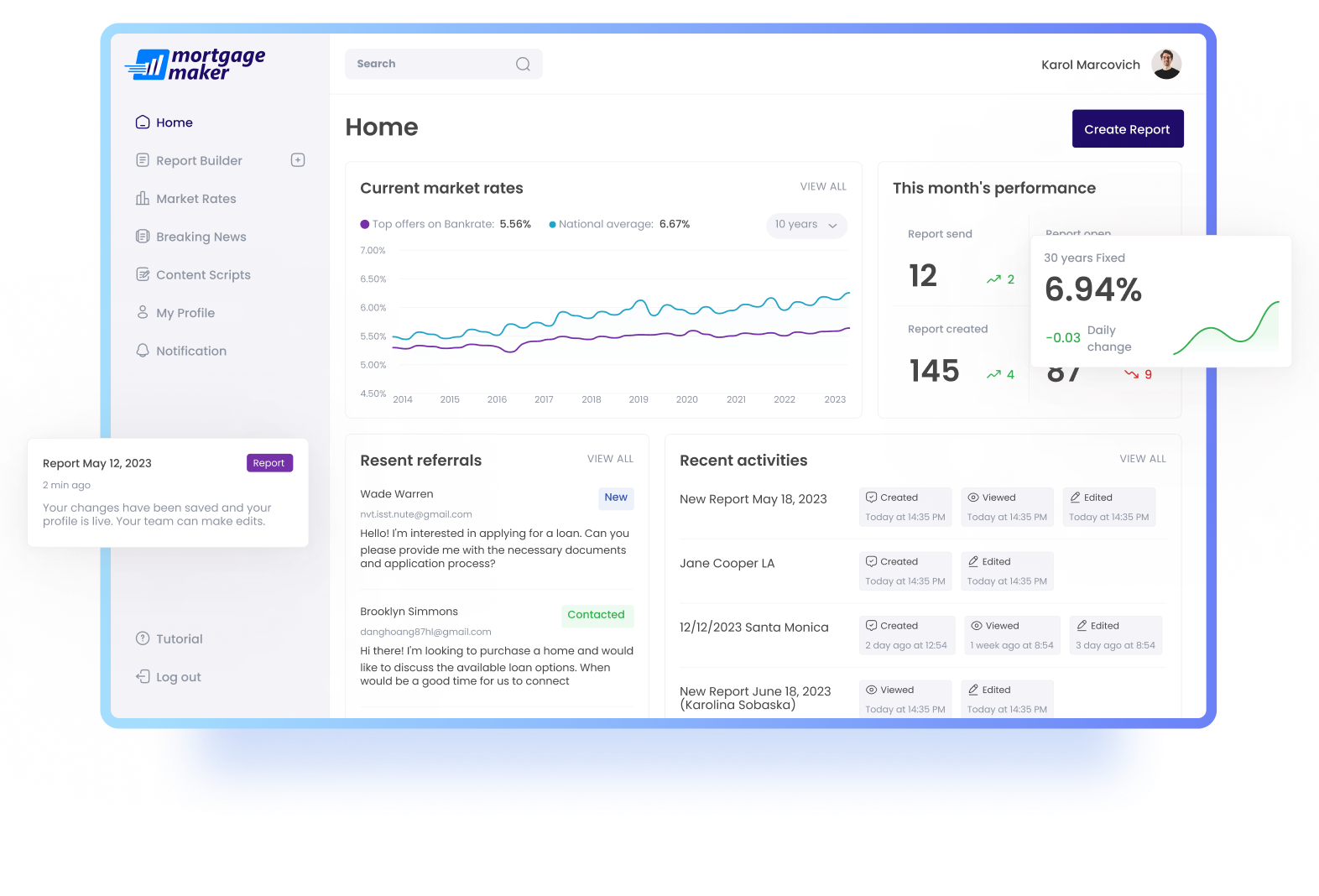

Today, that ball sits on our desk as a reminder of the mission: build intuitive, AI-powered mortgage presentation software that actually gets used, actually closes deals, and actually makes your job easier. Mortgage Maker AI wasn’t built for show—it was built for the modern loan officer who needs smarter tools, faster answers, and software that works the way you do.

At Mortgage Maker AI, we didn’t start with venture capital decks or whiteboard theories—we started with hundreds of real conversations with mortgage professionals frustrated by tools that didn’t fit how they actually work. Every insight shaped the product, and with each improvement, another rubber band was added to the ball.

Sara K. recommended we add side-by-side comparison tools:

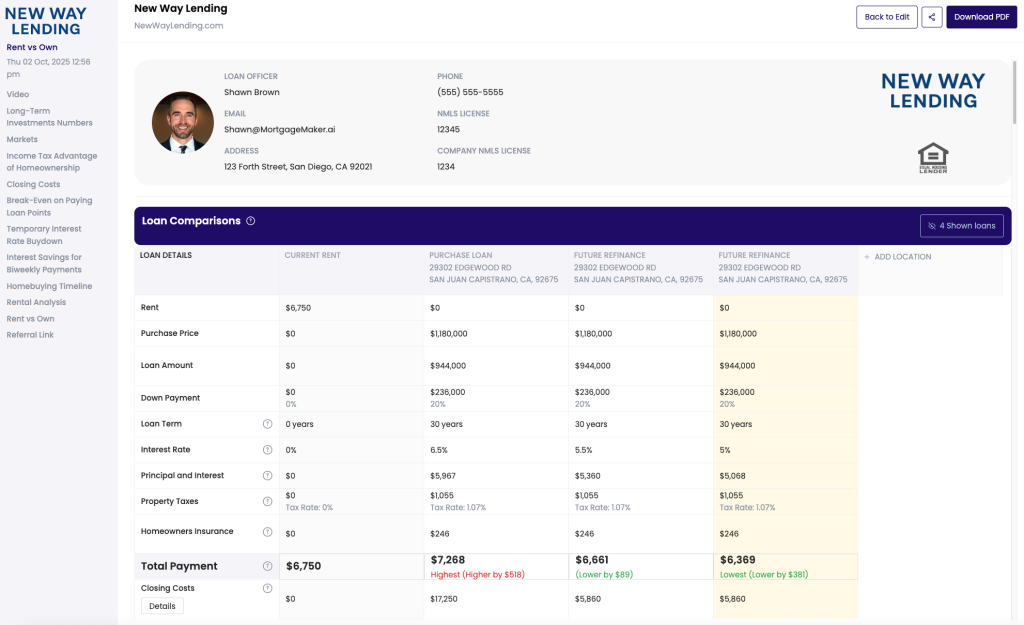

“I just want to show side-by-side comparisons without opening five windows and dragging in screenshots.”

We knew exactly what that frustration felt like. So we created a single-screen, side-by-side comparison tool that pulls live rate data automatically. No toggling. No exporting. Just clarity.

And another rubber band was added.

Andy H. expressed frustration with time spent building reports:

“Can I just have something that’s presentation-ready in five minutes or less? A tool where I don’t have to spend hours aggregating data and manually building out reports?”

You bet. Our pre-built templates and AI-driven data population help loan officers generate polished reports in under five minutes, complete with borrower-specific projections. Simple. Easy. User-friendly.

And another rubber band was added.

Malik T. told us he always gets confused post-close:

“I just want to show side-by-side comparisons without opening five windows and dragging in screenshots.”

We knew exactly what that frustration felt like. So we created a single-screen,

side-by-side comparison tool that pulls live rate data automatically.

No toggling. No exporting. Just clarity.

And another rubber band was added.

We heard from Dante F. who wants more insight in borrower engagement:

“It’s frustrating when I send a report to a borrower and have no idea if they even opened it or looked at it.”

To solve that, we introduced borrower engagement tracking, a feature that notifies loan officers when clients open reports, how long they view each section, and where they spend the most time. It gives LOs the insight they need to follow up with precision and purpose.

And another rubber band was added.

When we say “we get it,” we’re not using marketing speak, we really mean it. We’ve sat across the table from confused borrowers. We’ve wrestled with outdated mortgage SaaS platforms. We’ve tried to explain interest rate breakdowns with systems that didn’t allow for flexibility or provide real-time updates

So we decided to do something different.

We stopped waiting for a mortgage SaaS tool that actually worked and met the modern demands and preferences of home buyer’s and went ahead and built one ourselves.

Today, the Mortgage Maker Ball is a mascot of sorts – colorful, simple, and unassuming, but built with intent. It lives on Shawn Brown’s desk, and whenever someone on the team solves a problem, simplifies a process, or ships something new, we add another band.

It’s not just about product milestones however.

It’s about:

Every user feedback call that led to a better feature.

Every moment a home buyer said, “I finally understand my options.”

Every referral that came from a clearer, more confident borrower experience.

We didn’t build Mortgage Maker AI to be the flashiest tool in the industry. We built it to be the most useful. The rubber band ball is a daily reminder that small ideas, when consistently added together, lead to something epic.

Legacy platforms weren’t built this way. They were built in silos, by people too far removed from the grind and out of touch with the REAL issues brokers and loan officers face with mortgage SaaS platforms.

Ours was built in the field. By us. For us. For you.

Built by industry professionals who understand the struggles and challenges that modern mortgage loan officers face, the Mortgage Maker team explored how AI technology enhances mortgage presentation software and then built a software platform powered by artificial intelligence, making it an indispensable tool for mortgage professionals aiming to be at the top of their game in today’s market.

This isn’t just a story about building a better mortgage tool, it’s your story too.

See how Mortgage Maker AI helps loan officers like you close more deals, faster.