Mortgage Maker Differentiators

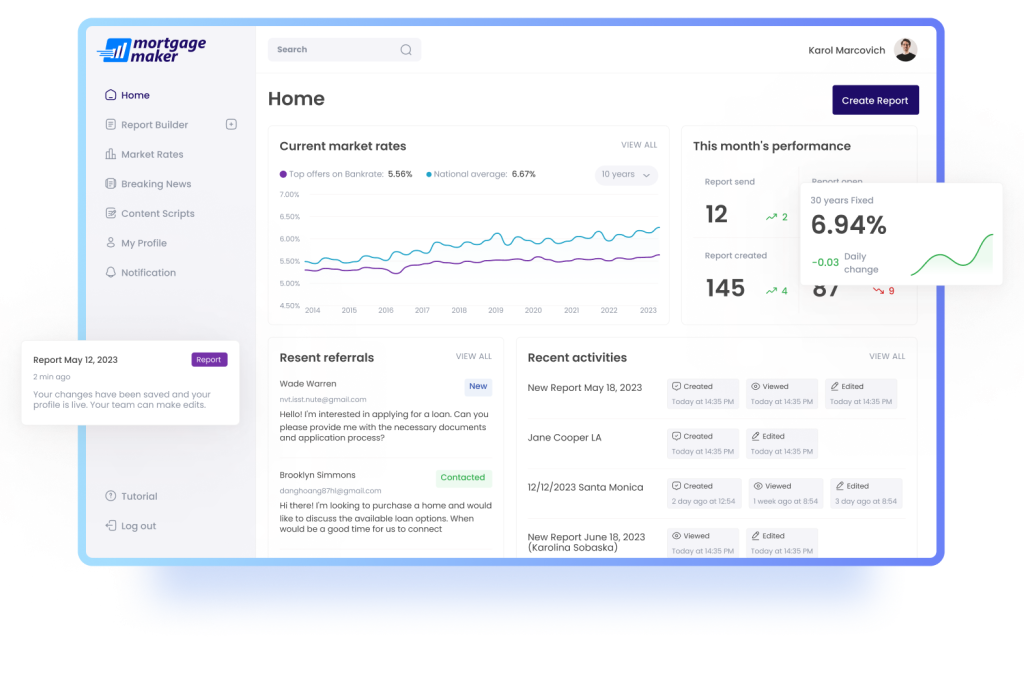

Mortgage Maker provides a fast and frictionless way to win borrower trust and close more deals with beautiful, compliant, plug-and-play presentations that loan officers can start using confidently in days, not weeks.

(hover your mouse over each card for the solution)

Manual, error-prone, consumes time better spent with clients.

Too complex, training required, slow adoption.

Lacks intuitive, borrower-ready presentation tools making it less effective for client-facing loan scenarios.

Built BY mortgage loan officers FOR mortgage loan officers. Plug-and-play, intuitive UI, live data, borrower trust built in.

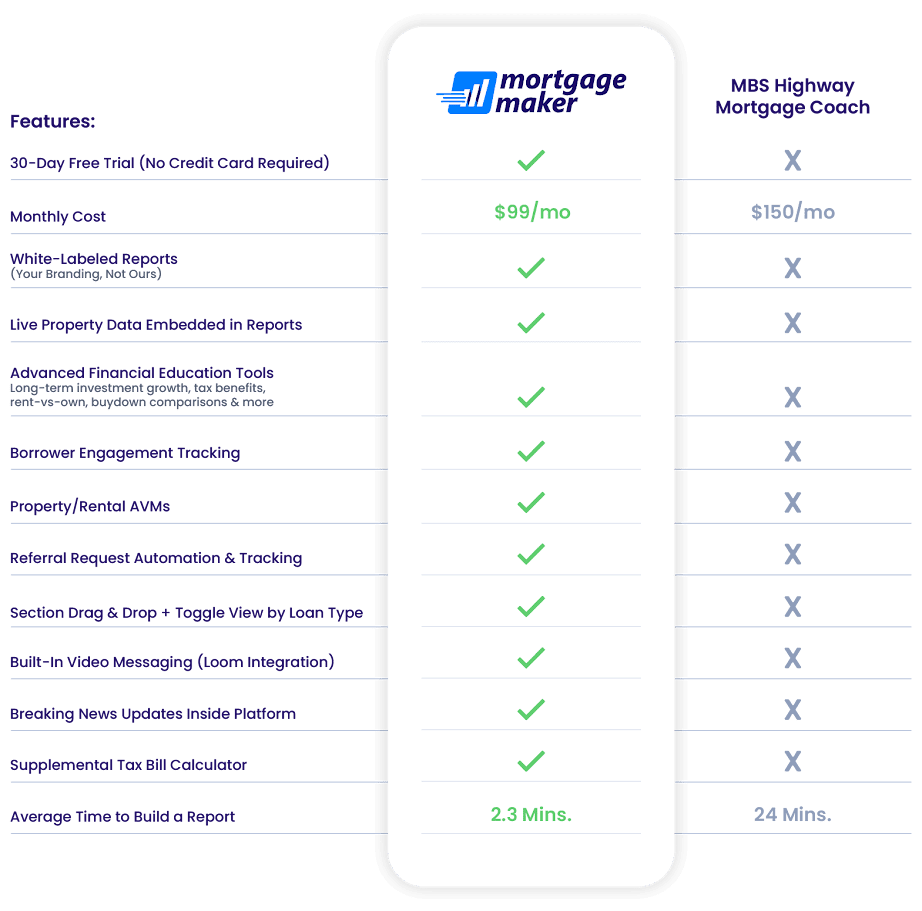

Built for speed, clarity, and borrower-ready impact—Mortgage Maker replaces outdated platforms with intelligent automation and clean design.

Competitors added AI later; Mortgage Maker was built on AI.

No manual entry needed for property values, taxes, and closing costs.

Loan officers can toggle & drag-drop sections for a fully personalized borrower experience.

Long-term wealth-building insights not found in other platforms.

Referral-sharing links, rate notifications, and embedded videos keep borrowers engaged.

Rate shifts, tax benefits, biweekly payments, and temporary buydowns are built into the same report

Simplifies the home insurance process within the same platform.