Understanding the Federal Funds Rate and Mortgage Rates

For mortgage professionals, few topics cause more confusion than the relationship between the federal funds rate and mortgage rates. Clients ask about it. News headlines hype it. Industry talking heads obsess about it. And yet, many brokers are still unsure of how these two rates actually interact, or whether they even do.

Let’s cut through the noise.

What Is the Federal Funds Rate?

The federal funds rate is the interest rate that banks charge each other for overnight loans. It’s controlled by the Federal Reserve and acts as a benchmark for short-term interest rates across the U.S. economy.

When the Fed raises or lowers this rate, it’s trying to influence broader economic conditions, most commonly, inflation, employment, and economic growth.

But here’s the key point: the federal funds rate does not directly control mortgage rates.

Federal Interest Rate vs Mortgage Rate: What's the Difference?

This is where the confusion starts.

The federal interest rate (the federal funds rate) is tied to short-term lending between institutions. Mortgage rates, on the other hand, are based on long-term lending, typically influenced by the 10-year Treasury yield.

When the Fed raises or lowers the funds rate, it often causes a ripple effect across the bond market, which in turn affects mortgage rates. But it’s not a one-to-one relationship.

Sometimes mortgage rates fall even when the Fed raises rates. Other times, they rise despite Fed cuts. Why? Because markets anticipate these moves and price them in ahead of time.

What Actually Drives Mortgage Rates?

Here’s what loan officers and brokers should be watching:

1. 10-Year Treasury Yield (Most Important)

This is the strongest predictor of 30-year mortgage rates. When Treasury yields go up, mortgage rates usually rise too.

Keep tabs on 10-Year Treasury yields here.

2. Inflation Data

Higher inflation erodes the value of bonds, which leads to higher interest rates. Mortgage rates tend to climb when inflation is high or accelerating.

Keep an eye on inflation rates here.

3. Economic Growth Indicators

Strong GDP growth, job creation, and consumer spending can push rates higher. Weak economic data tends to bring rates down.

4. Federal Reserve Policy

While not a direct driver, Fed policy influences rate sentiment. Statements from the Fed about inflation, employment, or recession fears can sway markets.

5. Political Climate and Global Events

Geopolitical uncertainty, elections, wars, or supply chain issues can drive investors toward safe assets like U.S. Treasuries, pushing yields (and mortgage rates) up or down.

So, What Should Mortgage Brokers Focus On?

If you’re a loan officer or broker, focus on these three things:

- Watch the 10-year Treasury yield daily or weekly. It’s your best indicator.

- Read the Fed’s tone, not just the headlines. Is it hawkish or dovish? A hawkish Fed prioritizes controlling inflation, potentially through raising interest rates, even if it slows economic growth. Conversely, a dovish Fed prioritizes stimulating economic growth, potentially through lower interest rates, even if it leads to higher inflation.

- Simplify the message for borrowers. Most clients just want to know if now is a good time to lock or float. What mortgage presentation software tools are you using to help visualize loan scenarios for your clients? Now may be the time to give Mortgage Maker AI a 30-day free trial.

How Mortgage Maker AI Can Help You Respond in Real Time

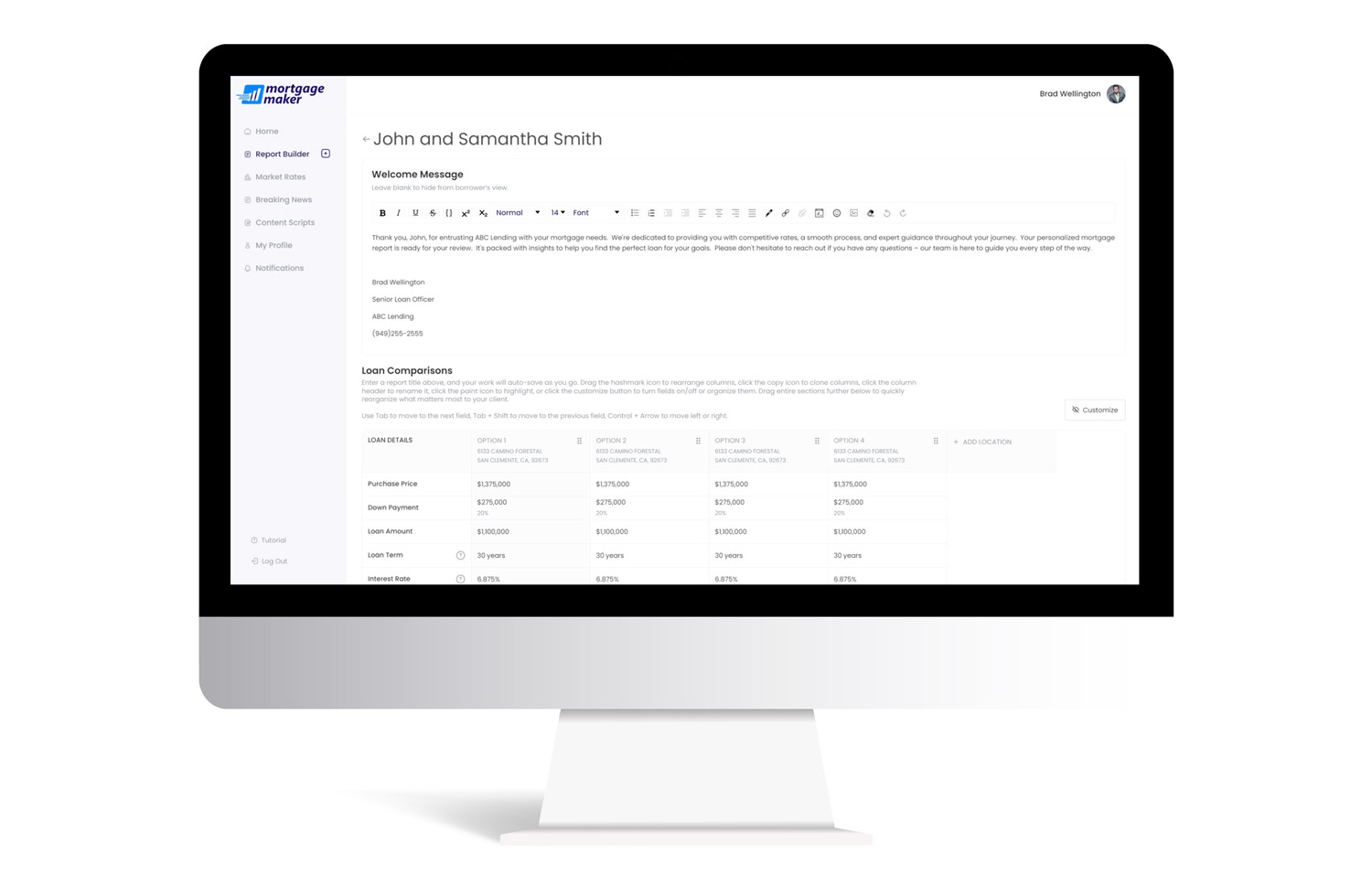

In a volatile rate environment, speed, clarity and confidence win deals. With Mortgage Maker AI, you can:

- Instantly generate loan comparisons based on current rates

- Deliver professional presentations that demystify rate changes

- Empower borrowers with side-by-side visuals that make complex decisions simple

You don’t need to predict what the Fed will do. You just need to be the most prepared, most clear, and most confident professional in the room.