Why Mortgage Presentation Software Is the Key to Building Borrower Trust and Staying Competitive

What Today’s Loan Officers Really Think About Technology, Fear, and the Future of Mortgage Lending

The mortgage industry is, and has been for quite some time, in transition. Modern borrowers expect faster answers, clearer communication, a high degree of transparency, and a more modern experience than, unfortunately, many loan officers are equipped to deliver. Simultaneously, mortgage technology promises to solve these challenges, but hesitation remains. To understand what today’s high-performing loan officers really think, we created a faux persona of Alex Carter, a seasoned mortgage broker who embodies the opportunities and concerns shaping the market.

Alex’s perspective offers a roadmap for where the industry is heading, what fears are overblown, and what lessons mortgage professionals can borrow from other fields to stay competitive.

Learning From Other Industries

Alex believes the mortgage industry has important and relevant lessons to learn from other sectors such as fintech, e-commerce, and healthcare. These industries embraced SaaS platforms years ago to handle workflows, automate processes, and deliver superior customer experiences.

In fintech, real-time dashboards let investment advisors instantly show clients how markets impact their portfolios. In e-commerce, customers expect fast, transparent checkout processes supported by powerful back-end automation. Healthcare has leveraged software to digitize patient records and healthcare data, making interactions faster and more efficient.

For Alex, the takeaway is rather simple: if loan officers had access to similarly intuitive software, they could spend less time struggling with clunky legacy systems and more time doing what they do best – building trust and earning referrals with borrowers.

Overblown Fear: Tech Adoption is Too Disruptive

A common theme in the mortgage world is fear of disruption when adopting new technology. Many mortgage brokers and loan officers worry about steep learning curves, compliance concerns, or losing control of client interactions. Time is already a precious commodity, and the misplaced fear of getting mired in SaaS muck and grind is enough to scare anyone away from adoption and implementation.

Alex views this fear as misguided. He argues that the greater risk lies in sticking with outdated tools – ones that few use to their capacity and are often characterized by steep learning curves and cumbersome and complicated ongoing training. Slow software creates bottlenecks. Confusing reports frustrate borrowers. Missed opportunities pile up while competitors move faster with more efficient and user-friendly technology.

For Alex, technology should never get in the way. It should simplify the process, reduce manual effort, and empower loan officers to have stronger conversations with clients. He sees tools like Mortgage Maker as examples of how modern SaaS can support, not disrupt, the work of a loan originator.

Bold Prediction: Mortgage AI Tools Will Become Ubiquituous

Although there are industry thought leaders that believe mortgage SaaS solutions developed and built with AI at their core are the future of the industry, many others remain skeptical that AI will have a meaningful impact on mortgage lending.

Alex predicts the opposite. He sees a future where AI-driven presentation software is not a nice-to-have, but a standard that borrowers expect and loan officers rely on.

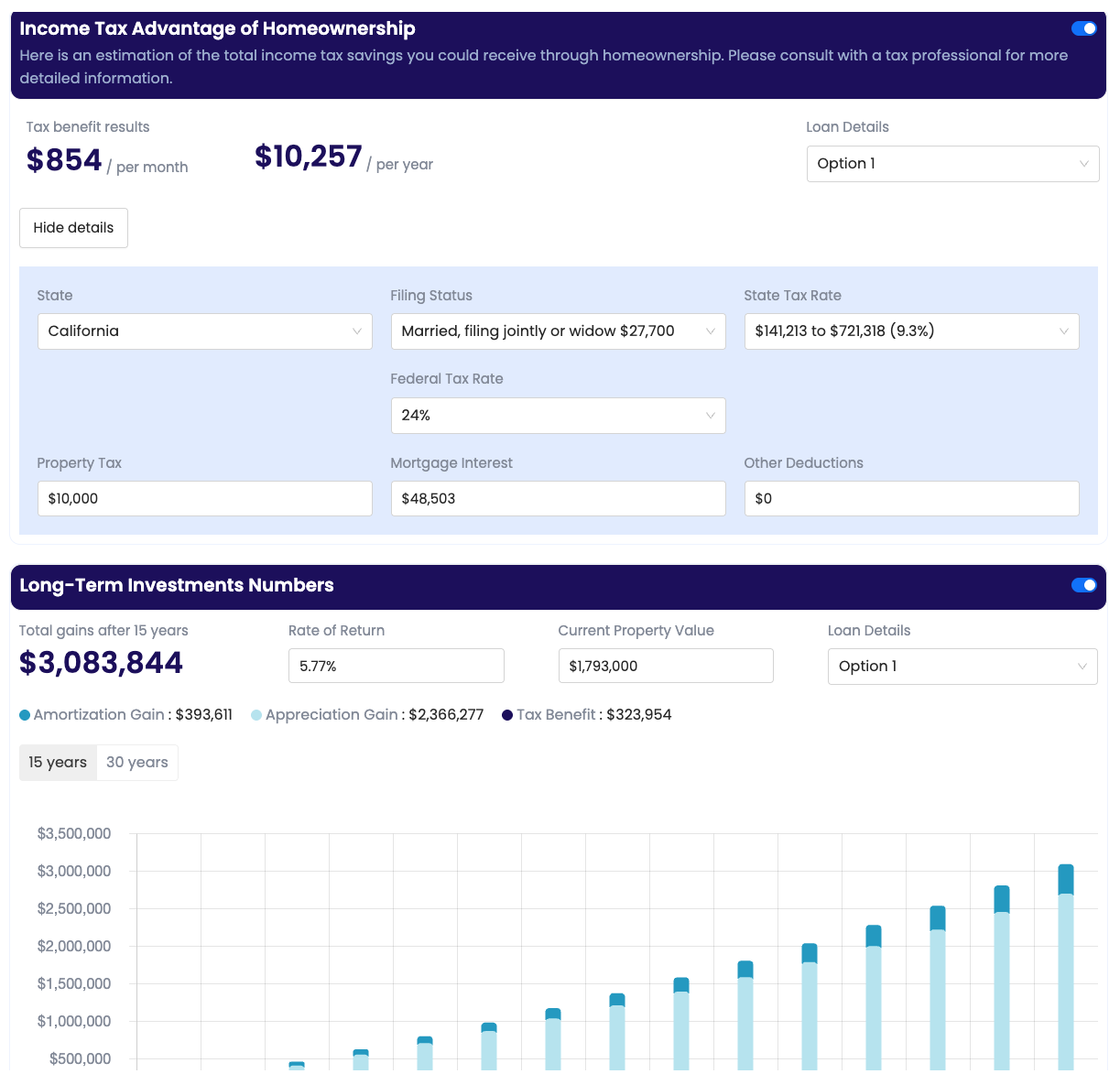

Why? Because AI enables speed, clarity, and personalization. It can pull in real-time data, generate scenarios instantly, and present them in borrower-friendly visuals. In a competitive environment, the loan officer who can deliver this experience will stand out every time. Period.

Alex’s bold belief is that in just a few years, those who resist AI will be at a significant disadvantage. Borrowers will gravitate toward professionals who can combine human expertise with the efficiency and clarity of AI-powered tools.

What Mortgage Officers Can Learn From Alex

Alex’s mindset provides valuable lessons for the entire mortgage industry:

- Adopt lessons from outside industries. SaaS adoption in other sectors shows that software is a tool for growth, not a threat or an instrument built to slow prodcutivity.

- Challenge outdated fears. The pain of staying with legacy systems is far greater than the learning curve of adopting modern tools.

- Prepare for AI. What seems unlikely to some will soon become the expectation, and those who move first will gain the competitive edge.

The Role of Mortgage Maker - A Modern Mortgage Presentation Software Solution

Mortgage Maker was built with professionals like Alex in mind. The mortgage presentation software platform reflects the principles he champions: simple workflows, borrower-friendly presentations, and AI-powered insights that help loan officers quickly build and sustain trust and ultimately, close more loans.

With Mortgage Maker, loan officers can quickly create reports that use live data, customize presentations to match borrower needs, and present everything in a way that builds trust. It is proof that the industry can embrace technology without losing the personal touch that makes mortgage lending unique.

Shaping the Future of Mortgage Lending

The fears, lessons, and predictions voiced by mortgage lending personas such as Alex Carter are not just hypothetical. They reflect real trends shaping the mortgage industry. From learning the lessons of other industries to embracing AI, the message is clear: the future belongs to those willing to evolve.

Mortgage Maker exists to make that evolution easier. By combining modern design with intuitive tools, it helps loan officers like Alex deliver the kind of borrower experience that defines tomorrow’s market leaders.