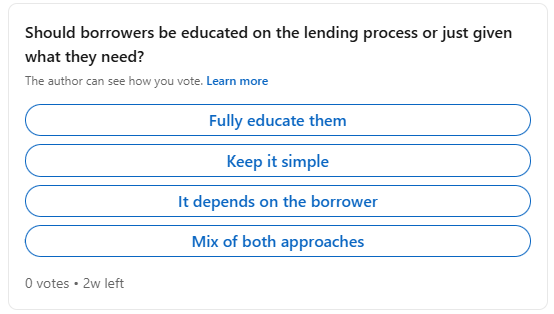

Find the LinkedIn poll here.

Engaging Mortgage Lenders in Essential Borrower Education Research

For mortgage lenders, understanding borrower education preferences is important to start a personalized relationship. To explore the topic more in-depth, the Mortgage Maker AI team has launched a LinkedIn poll titled: “Should borrowers be educated on the lending process or just given what they need?” This poll seeks to gather insights from industry professionals, with the goal of improving borrower experiences and streamlining lending processes.

The Importance of Borrower Education in Mortgage Lending

Educating borrowers about the mortgage process can lead to more informed decisions, potentially reducing default rates and fostering trust between lenders, realtors and clients. However, some argue that providing only essential information prevents overwhelming clients, thereby simplifying the process by removing what can be seen as confusing data. Striking the right balance is important to achieve optimal borrower satisfaction and operational efficiency.

Participate in Our Mortgage Lending Research LinkedIn Poll

We invite mortgage lenders, brokers, loan officers, and industry stakeholders to share their perspectives by participating in our LinkedIn poll. Your input is invaluable in shaping borrower education strategies that align with both industry best practices and client needs. Engage with us on LinkedIn and contribute to this important discussion.

How to Access the LinkedIn Poll

To participate, visit our LinkedIn post: Mortgage Maker AI’s Poll on Borrower Education. Cast your vote and join the conversation by sharing your insights in the comments section.

The Role of Mortgage Lender Research in Improving Best Practices

Continuous research and feedback collection are vital for the mortgage industry to adapt and thrive. By engaging in this poll, you’re contributing to a broader understanding of effective borrower communication strategies, which can lead to improved services, client satisfaction, and more closings.

Stay Connected with Mortgage Maker AI

For more insights and updates on mortgage lender research, follow Mortgage Maker AI on LinkedIn. We are exclusively committed to fostering discussions that drive innovation and excellence in the mortgage industry.

Your participation not only informs our research but also helps in strategizing borrower education approaches that benefit the entire industry. Join us in this endeavor to refine and enhance the mortgage lending experience for all.