The Future of AI Mortgage Lending: What You Need to Know Now

Mortgage professionals are hearing a lot about artificial intelligence (AI) these days but how many truly understand what kind of AI technology is powering their tools?

In a new thought leadership article published by HousingWire, Mortgage Maker AI Founder and CEO Shawn Brown breaks down what really matters when it comes to the use of AI in mortgage lending. The piece is a wake-up call for brokers and loan officers who are navigating a sea of software solutions, each claiming to be “AI-powered.”

Spoiler Alert: not all AI is created equal.

Not All AI Is Created Equal in Mortgage Lending

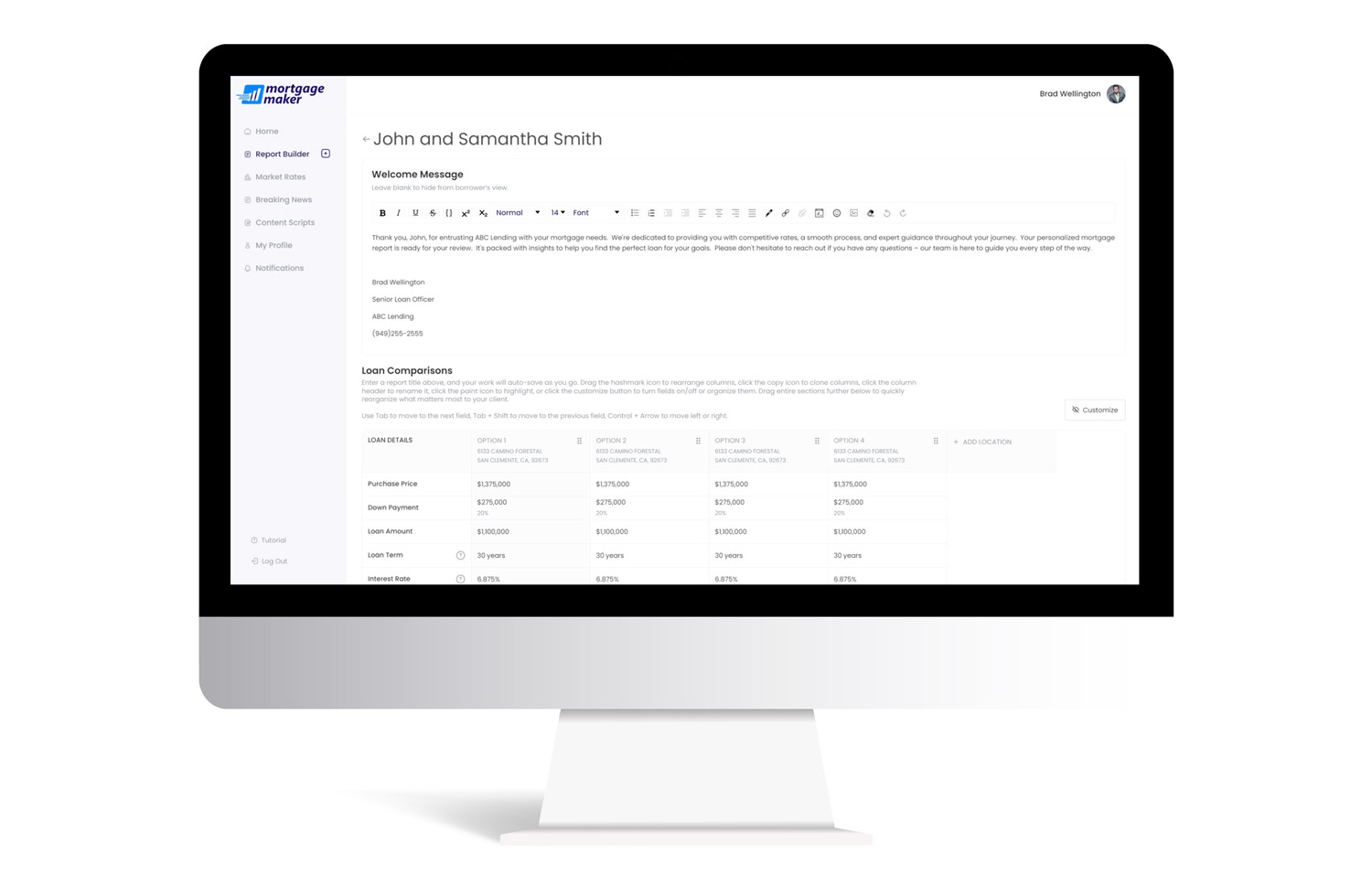

As Shawn explains in the article, the type of AI behind a mortgage SaaS platform has a direct impact on how effective it will be in the real world. Some tools rely on predictive AI to crunch data and surface insights. Others, like Mortgage Maker AI, are pushing into agentic AI, defined as systems that take autonomous action and actually move deals forward.

This distinction matters because your borrowers aren’t just expecting speed and accuracy anymore. They want real-time answers, personalized experiences, and a seamless digital process.

If your software isn’t helping you deliver that, you’re falling behind. Fast.

The Real Questions Brokers and Loan Officers Should Be Asking

Shawn’s HousingWire article urges mortgage professionals to go deeper than the generative AI buzzwords. Instead of asking if a platform uses AI, you should be asking:

- What type of AI powers this software?

- How does it improve the borrower experience?

- Does it help me close more loans with less effort?

- Can it adapt to my unique workflow and pipeline?

With borrower expectations evolving and competition heating up, these aren’t technical questions but rather survival questions.

Read the Full Article on HousingWire

This is more than just a feature article. This is a blueprint for the future of AI mortgage lending. If you’re a loan officer, mortgage broker, or SaaS decision-maker, this AI thought leadership piece will help you cut through the noise and make smarter choices about the technology you use.

Read the full article on HousingWire:

The Coming Mortgage Boom: Why the Right Kind of AI Will Define the Next Era” – by Shawn Brown, Founder & CEO of Mortgage Maker AI

Want to stay ahead of what’s next in mortgage tech?

Join our brand new Facebook Group, LO Confidential, and be part of the conversation (yes, we discuss the use of AI in mortgage lending!).