How Mortgage Maker’s use of agentic AI is redefining speed, accuracy, and borrower trust.

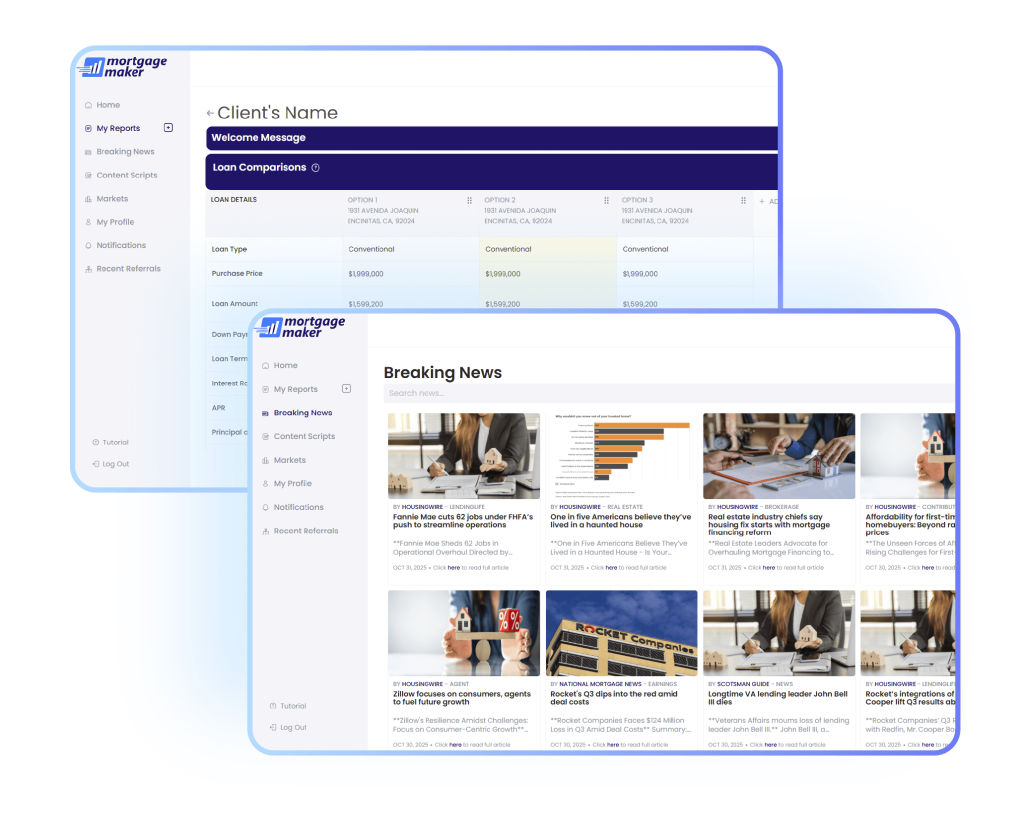

Legacy mortgage presentation software platforms were designed around manual workflows – however today’s borrowers expect speed, personalization, and clear insight.

In today’s competitive mortgage market, agentic AI-powered tools such as Mortgage Maker are essential for loan officers who want to save time, boost accuracy, and deliver client experiences that set them apart.

Mortgage Maker’s agentic AI integrates data, analyzes behavior, and delivers borrower narratives and custom scripts in seconds saving you hours per deal.

Discover how Mortgage Maker’s agentic AI is streamlining underwriting, transforming borrower engagement, and enabling smarter, faster loan closings.

AI pulls property, tax, market, and borrower data automatically.

Once data is aggregated, agentic AI analyzes borrower behaviors—such as report interaction speed, section dwell time, and scenario toggles—to surface readiness signals and flag areas of interest and intent.

Dynamically tailor report content based on borrower preferences—show or hide sections, re-order modules, and emphasize data that resonates most for each client.

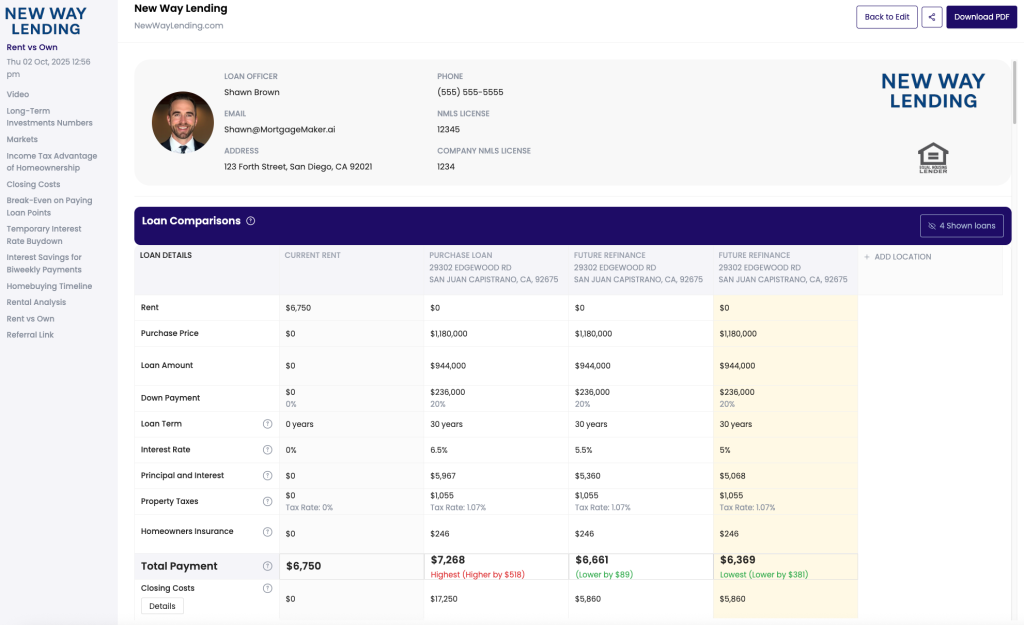

The proliferation of online mortgage tools, forums, groups, discussions, and other resources have made borrowers savvier than ever, often comparing multiple lenders before making a decision. Agentic AI-powered mortgage presentation software helps loan officers stand out by delivering comprehensive, easy-to-understand presentations that build trust and confidence.

See which parts of your presentation borrowers interact with most, revealing interest, urgency, and engagement in real time.

Instantly notify borrowers when market rate changes impact their affordability or monthly payments.

Tailor every mortgage report dynamically based on borrower preferences, toggles, and decision priorities.

AI converts complex loan data into clear, compelling stories borrowers can understand and trust.

Effortlessly deploy consistent, compliant presentations across branches, teams, and geographic regions.

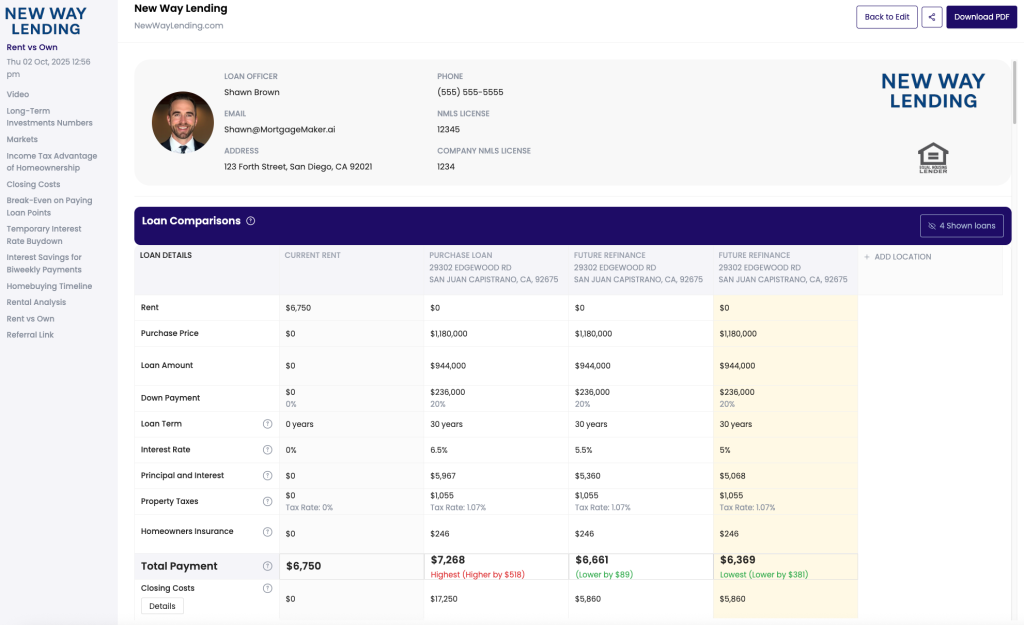

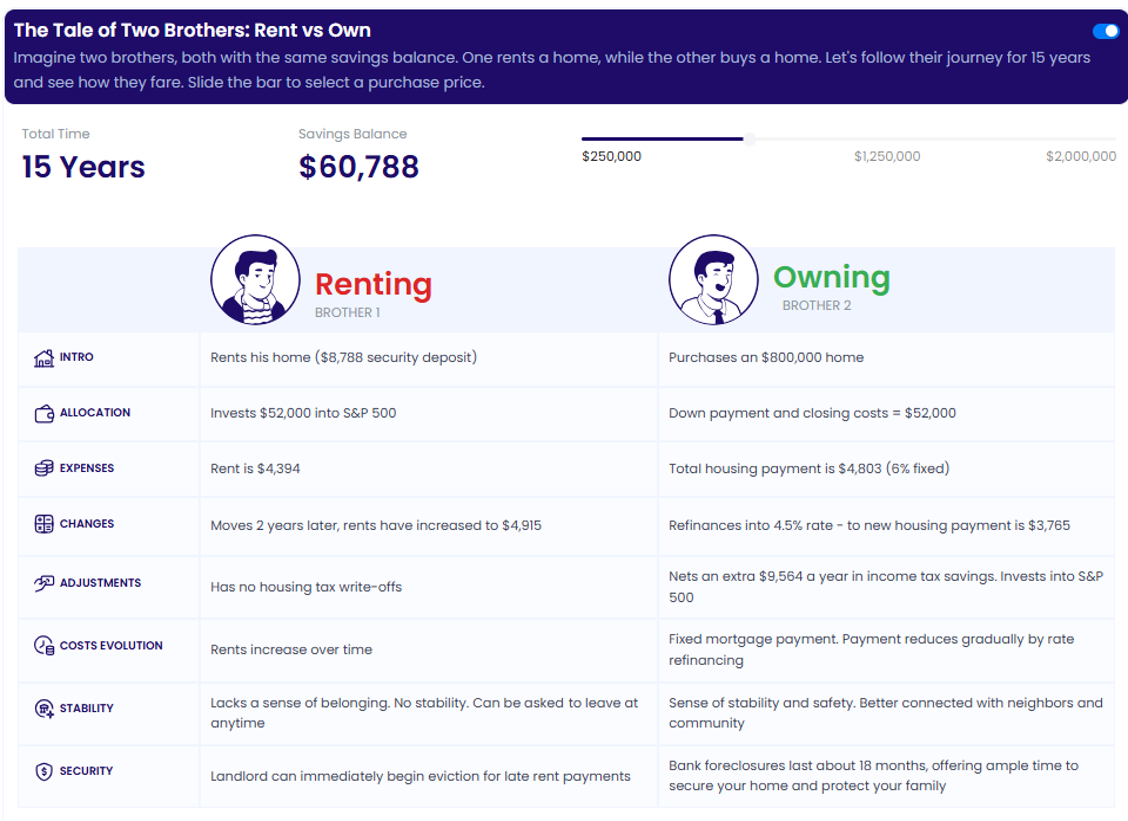

Features such as real-time pricing comparisons and toggling between purchase and refinance scenarios eliminate the need for manual calculations. Mortgage presentation software powered by Agentic AI technology ensures accuracy while freeing up time for strategic tasks.

Agentic AI mortgage platforms like Mortgage Maker are built to serve loan officers and brokers across the country. With AI handling data aggregation and analysis, location-based constraints are no longer an issue.

Time is money in the mortgage industry. Traditional mortgage software built on legacy technology can take 20–30 minutes to generate a report, whereas agentic AI-driven platforms such as Mortgage Maker produce detailed, customized presentations in just a few minutes. This speed not only boosts productivity but also ensures clients receive timely, professional service. Wondering what to do with the extra time an agentic AI based mortgage presentation software platform offers? Strengthening home buyer client relationships is a good start.

Modern borrowers demand tailored solutions. AI enables loan officers to create white-labeled, fully customizable reports that reflect their personal brand. Why is this important? Because it allows you to more effectively distinguish yourself from competitors and expand your brand footprint, create more memorable impressions on home buyers, and build trust which leads to increased customer loyalty and business value.

As we know all too well, the mortgage market evolves rapidly, and agentic AI-powered tools are built keep pace. Mortgage Maker’s agile development cycles allow it to incorporate features like seller-paid interest rate buy-downs and cash-out analysis features within weeks, ensuring loan officers always have the tools they need to stay competitive. Other legacy mortgage presentation software platforms simply do not have this capability.

Traditional mortgage tools built on outdated systems can’t keep pace with the speed and expectations of today’s home buyers. Agentic AI platforms like Mortgage Maker are transforming the way loan officers operate—offering faster, smarter, and more personalized borrower experiences. In a data-rich market, having tech that adapts in real time is no longer a luxury, it’s a competitive necessity.

Agentic AI does more than just aggregate data; it analyzes it with lightning speed to provide actionable insights. For example, Mortgage Maker monitors borrower interactions with presentations. By tracking behaviors—such as how quickly a borrower views a report or interacts with specific sections—agentic AI helps loan officers identify hot leads and tailor follow-ups effectively. The more you can customize reporting to a home buyer’s unique needs and the faster you can react to their engagement, the more deals you will be able to close.

Auto‑data, interactive reports, engagement alerts—all for $79/mo. (billed annually)