Beyond Chatbots: Embracing Agentic AI in Mortgage Lending

The mortgage industry has been buzzing with discussions about artificial intelligence (AI), primarily focusing on generative AI tools like ChatGPT and customer service chatbots. While it’s true these technologies have enhanced content creation and customer interactions, they represent just the tip of the iceberg.

A more profound transformation is underway with the advent of Agentic AI, poised to revolutionize mortgage lending by automating complex tasks and enhancing decision-making processes.

Understanding Agentic AI

Agentic AI refers to systems capable of autonomous decision-making and task execution without constant human intervention. Unlike generative AI, which creates content based on user prompts, agentic AI proactively analyzes data, makes informed decisions, and performs actions to achieve specific goals. This autonomy allows agentic AI to adapt to changing circumstances and optimize outcomes in real-time – all key steps in meeting the demands of today’s modern home buyers.

Agentic AI vs. Generative AI

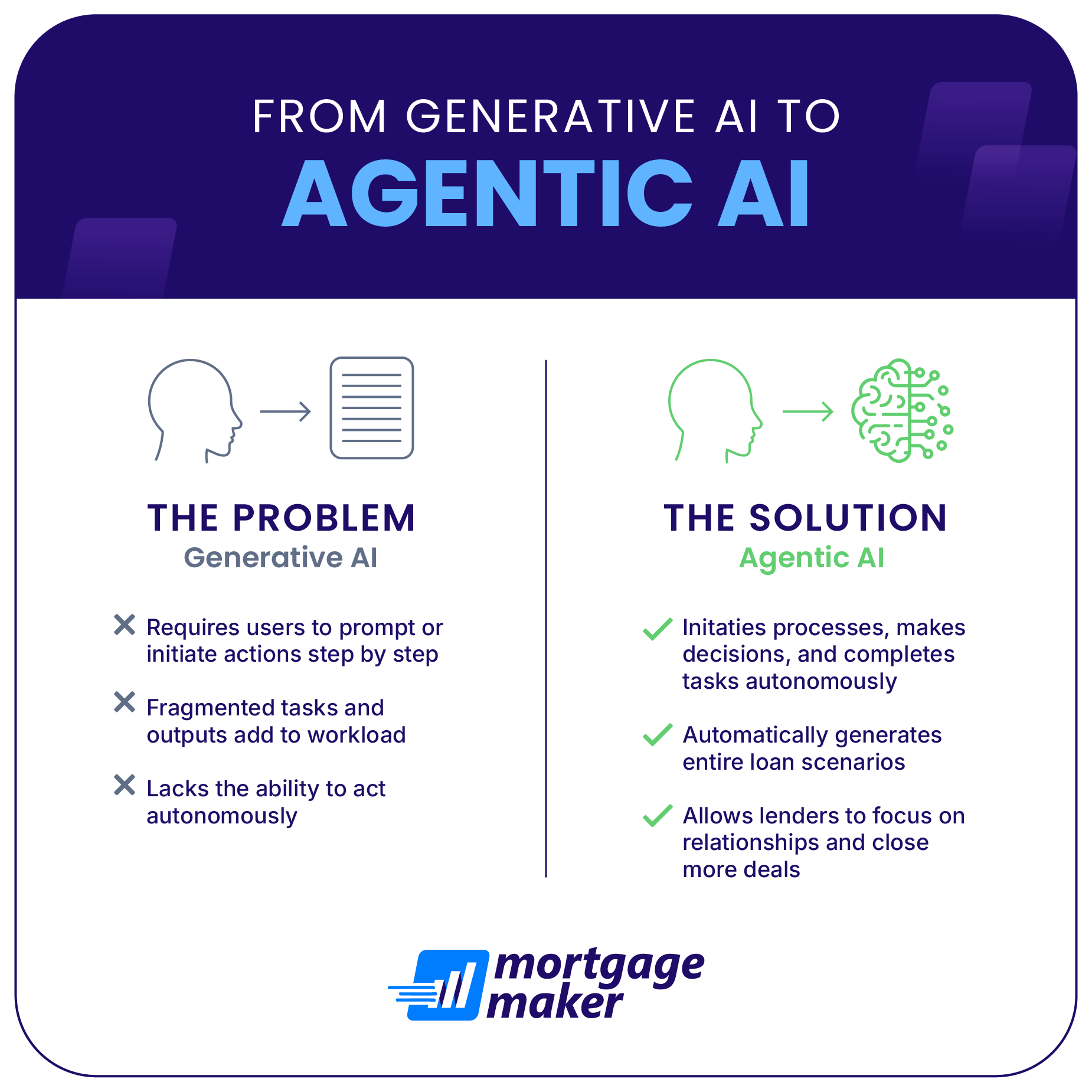

While both fall under the AI umbrella, agentic and generative AI serve distinct functions:

- Generative AI: Focuses on creating new content, such as drafting emails or generating marketing copy, based on existing data and user inputs.

- Agentic AI: Emphasizes autonomous action and decision-making, capable of managing complex processes like loan origination, underwriting, and compliance checks without human oversight.

In essence, while generative AI is reactive, responding to specific prompts, agentic AI is proactive, initiating actions based on data analysis and predefined objectives.

The Impact of Agentic AI on Mortgage Lending

Integrating Agentic AI into mortgage SaaS platforms offers several transformative benefits:

- Enhanced Efficiency: Agentic AI automates routine tasks such as data entry, document verification, and compliance monitoring, allowing loan officers to focus on strategic decision-making and client relationships.

- Real-Time Decision Making: By continuously analyzing market trends and borrower data, Agentic AI enables mortgage brokers and lenders to make informed decisions quickly, adapting to market fluctuations and borrower needs effectively.

- Improved Accuracy: Automated processes reduce the risk of human error in calculations and data analysis, leading to more accurate loan assessments and compliance adherence.

- Scalability: Agentic AI systems can handle increased workloads without a proportional increase in resources, allowing lenders to scale operations efficiently.

The Mortgage Tech Shift That No One Is Talking About

The mortgage industry is in the middle of a transformation, but most discussions still focus on how loan officers can use Generative AI tools like ChatGPT to write emails instead of how Agentic AI is changing the way loans are structured and presented. In our opinion, Generative AI is not where the conversation should be.

What’s missing from the conversation?

- The distinct advantages Agentic AI-driven mortgage platforms provide for loan officers and borrowers.

- The risks of relying on outdated mortgage tech in today’s fast-paced market.

- The growing divide between mortgage professionals who adopt Agnetic AI tools and those who do not.

As AI continues to evolve, the mortgage professionals who leverage Agnetic AI-powered tools will dominate the industry, while those who don’t will struggle to keep up. That’s worth repeating. If mortgage lenders can’t move past Generative AI discussions and pivot the focus to how Agentic AI impacts how loans are structured and presented, they are quickly going to be irrelevant.

AI Mortgage Lending Is the Future—Are You Ready?

Mortgage lenders need to shift their mindset from using Generative AI for content creation to leveraging Agentic AI-powered mortgage platforms to increase efficiency, accuracy, and borrower satisfaction.

If you’re still relying on static presentations and outdated mortgage software, now is the time to explore Agentic AI-driven mortgage lending tools that can streamline your processes and give you a competitive edge.

The Agentic AI mortgage lending revolution is here—are you ready to embrace it?