Strengthening Client Trust: Strategies for Success in Mortgage Lending

In an era where the world of mortgage lending requires a fresh approach and a different mindset, success extends far beyond securing the best rates for your clients. No question that competitive rates are a critical factor, however the Mortgage Maker team is here to tell you that building trust and fostering long-term relationships are equally essential to ensuring client satisfaction, driving business growth and, the golden chalice of them all – securing an ever increasing number of trusted referrals.

Mortgage lending in 2025 is different though. By focusing on personalized service, transparent communication, and leveraging powerful mortgage presentation software, lenders can create a client experience that not only meets but exceeds expectations. It’s what 2025 buyers expect and if you aren’t developing a strategy to meet this rising need for personalized and customizable buyer data, you’re bound to fail. Here’s how to make it happen.

The Importance of Transparency in Rate Discussions

Transparency is a cornerstone of trust in mortgage lending. Clients often feel overwhelmed by the complexities of mortgage terms, interest rates, taxes, commissions, and fees. Mortgage lenders who take the time to explain these details in clear, straightforward language can alleviate confusion and help clients feel more confident in their decisions.

A study by Utah State University found that clients who understand their mortgage terms are less likely to default on their loans and more likely to refer their lender to others. The moral of the story? This highlights how transparency can directly impact both client satisfaction and your bottom line.

By addressing potential concerns upfront and maintaining open communication throughout the lending process, you demonstrate a commitment to your clients’ best interests and don’t come across as “blindly working for the commission.” This approach not only builds trust but also establishes a foundation for a lasting relationship and potential warm referrals down the road. #WINNING.

Personalizing Client Interactions with Mortgage Presentation Software

Personalization is another key element of building strong client relationships. Close your eyes and think about what “personalization” actually means when it comes to mortgage lending in 2025. Any thoughts you have MUST include the use of modern tools such as mortgage presentation software that allow lenders to tailor their approach to each buyer’s unique needs and preferences. Most buyers are only interested in information and data that pertains to their own unique circumstances and not as much in broader market analyses. And perhaps most importantly, buyers want REAL-TIME data so they are better positioned to make strategic decisions at a moment’s notice with the confidence that they are acting with the most recent data available. Trust, transparency, insight, actionable data. Sounds reasonable, right?

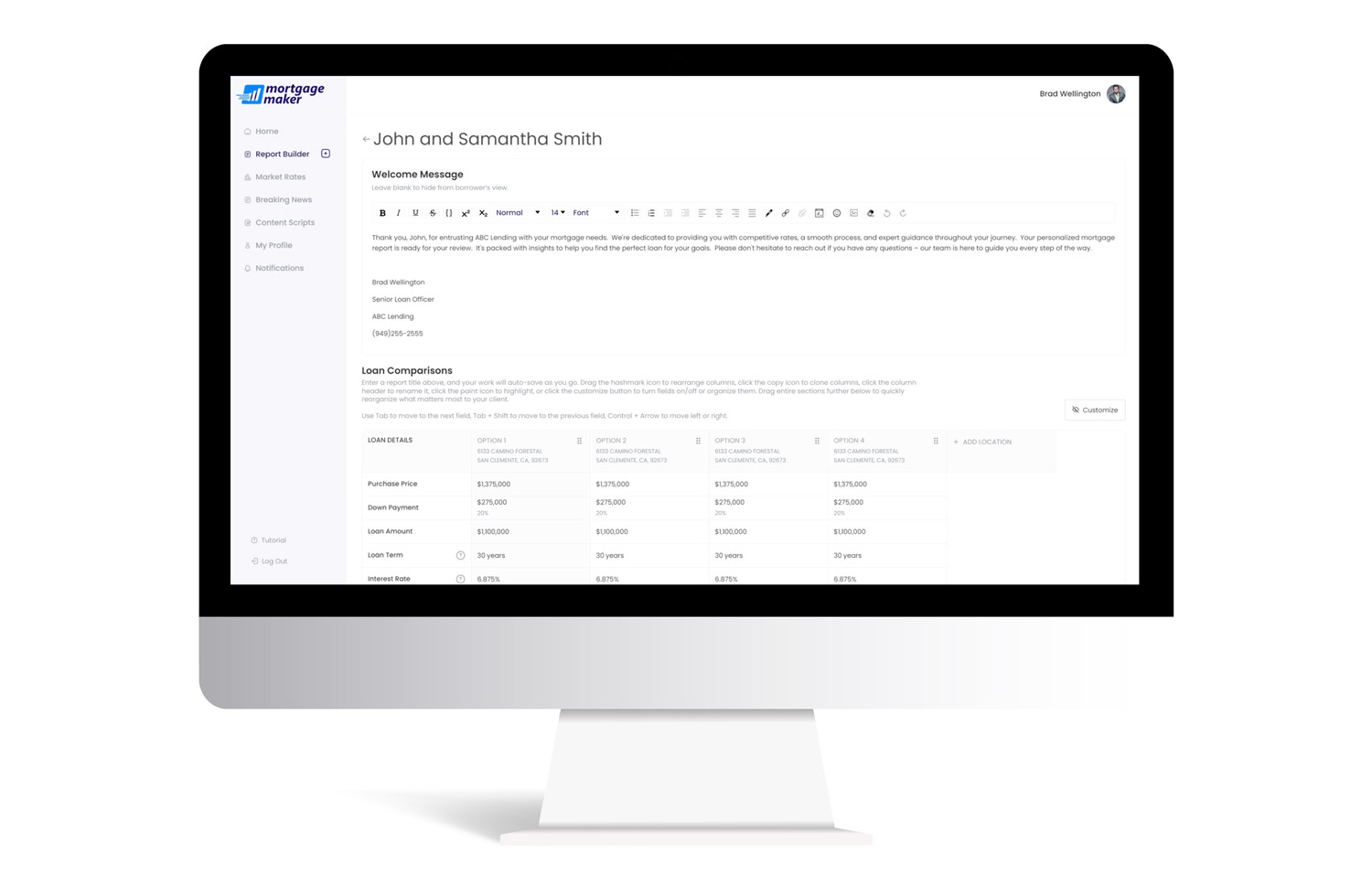

To give you an example, with tools provided by digital mortgage solutions, lenders can:

- Create detailed, visually appealing loan comparisons tailored to the client’s financial situation.

- Showcase various scenarios that align with the client’s short- and long-term goals.

- Provide real-time updates on rate changes or loan status, keeping clients informed every step of the way.

This level of personalization not only enhances the buyer experience but also positions you, the mortgage lender, as a proactive, trusted and attentive advisor. Clients are more likely to feel valued and confident when their lender takes the time to understand their unique needs. It demonstrates trust and empathy – two foundational linchpins of mortgage lending success.

Real-World Examples of Enhanced Client Trust Leading to Referrals

Building trust through transparency and personalization doesn’t just improve individual client relationships—it can also drive referrals, a key growth driver in the mortgage industry.

Consider the case of a lender who told the Mortgage Maker team about using a loan origination platform to deliver customized mortgage scenarios for a first-time homebuyer. The client was so impressed with the clarity and detail provided that they referred three additional friends and family members within six months. Each referral turned into a closed loan, generating significant revenue for the lender and helping them to exceed their quarterly and yearly goals. Boom!

According to the National Association of Realtors (NAR), over 40% of homebuyers choose their lender based on a referral. This underscores the value of strong client relationships in expanding your network and driving new business opportunities.

Leveraging Technology to Build Stronger Relationships

Like most industries, modern mortgage lending is increasingly driven by technology. Platforms like Mortgage Maker offer comprehensive digital mortgage solutions that streamline the lending process while enhancing client communication and service delivery.

Key features of these platforms include:

- Interactive Loan Presentations: Simplify complex mortgage details into easy-to-understand visuals.

- Client Portals: Provide clients with 24/7 access to their loan status, reducing anxiety and boosting transparency.

- Data-Driven Insights: Use client data to identify opportunities for personalized recommendations and cross-selling.

By incorporating these tools into your workflow, you’re not just improving operational efficiency—you’re creating a more engaging and satisfying experience for your clients. Referrals anyone?

Actionable Tips for Strengthening Client Relationships

- Be Proactive in Communication: We can’t stress this one enough. Regularly update clients on the status of their loan application and any changes in market conditions that might affect their mortgage. DO NOT wait for them to contact you.

- Educate Your Clients (i.e. be a “Financial Literary Expert”): Use tools like mortgage presentation software to provide clear, concise explanations of loan options and terms. Go beyond just rattling off numbers on a page, and dive deeper into the true meaning of leading economic indicators and their impact on mortgage rates.

- Seek Feedback: After closing, ask for feedback on their experience. Use this information to identify areas for improvement. Set on making improvements that will lead to more referrals and closings and keep your pipeline full? You’ve got to ask for feedback.

- Pro tip: Use a survey platform such as SurveyMonkey to create customizable post close buyer surveys.

- Follow Up: Maintain contact with past clients through newsletters, check-ins, or helpful resources to keep your services top of mind. Keeping yourself top of mind means you’re more likely to secure referrals that convert.

The Bottom Line

Building stronger client relationships in mortgage lending requires a commitment to transparency, personalization, and leveraging modern technology. By adopting these strategies, you can create a client experience that not only drives satisfaction but also builds loyalty and referrals.

For more information on how Mortgage Maker can help you enhance client relationships through innovative digital mortgage solutions, explore our platform today. Together, we can go beyond the numbers and build connections that last a lifetime.

Cheers to 2025!