The Excitement of Buying a Home… and the Challenges That Followed

Buying a home is often described as one of life’s most rewarding milestones but for many borrowers, the process is filled with challenges, confusion, and uncertainty. My girlfriend and I recently went through this experience when purchasing a home out west. While we were super excited to find a property we loved, the mortgage process left us frustrated and looking for better communication, clarity, and tools that could have eased the stress of making such a significant financial decision. Looking back, I can’t help but imagine how much smoother the process would have been if our mortgage lender had access to a tool such as Mortgage Maker.

Our Journey Through the Mortgage Process: What Worked and What Didn’t

The Good: A Knowledgeable and Friendly Mortgage Lender

From the moment we decided to make an offer, it was clear that navigating the mortgage process was going to be a steep learning curve. Neither of us had purchased a home since the late 90’s so we suspected that there were major changes in how the mortgage lending process was vetted and administered. We started by engaging with a mortgage lender at a local bank who was courteous, knowledgeable, and eager to help. She had a strong understanding of market conditions and current leading economic indicators that impact mortgage rates and expertly guided us through the pre-approval process. While we appreciated her expertise, we found ourselves frequently struggling to get the information we needed in a clear and actionable format. We don’t blame our mortgage lender, as we knew she didn’t have access to a modern mortgage presentation software tool to help inject clarity into the entire loan process.

The Bad: A Lack of Comprehensive, Interactive Insights

Lack of Comparative Loan Scenarios

One of our biggest challenges was understanding our loan options. Despite our lender’s verbal explanations, we didn’t receive any detailed, written loan comparisons. This meant we couldn’t easily weigh the pros and cons of different scenarios, such as varying down payments or interest rate buy-down strategies. For pseudo first-time homebuyers in the modern era like us, visualizing these options with side-by-side comparisons would have been invaluable.

Unclear Income Tax Advantages

Owning a home comes with potential tax benefits, but we had to research most of this on our own. It would have been helpful to see an analysis of how our home purchase could impact our taxes, especially if presented in a clean, professional report. This lack of information added unnecessary stress and anxiety to an already complex decision-making process.

Ambiguity Around Closing Costs

Closing costs were another one of our pain points. We asked our lender multiple times for an estimate, but the information was often vague and incomplete. This made it difficult for us to budget accurately and left us feeling unprepared for one of the most critical financial aspects of buying a home.

No Long-Term Investment Insights

As business professionals, we also wanted to understand the potential long-term investment return value of the property. What would the house be worth in five, ten, or fifteen years? Could it be a smart financial move to sell in the future? Unfortunately, this type of data wasn’t readily available from our lender leaving us in the dark about the potential long-term investment opportunities we could potentially leverage.

Missing Reports and Analysis Tools

Additionally, we didn’t receive:

- A break-even analysis on paying loan points

- A temporary interest rate buydown analysis report

- A renting vs. owning comparison report

- A 15-year forecast on the financial difference between renting and owning

These tools would have made a world of difference in helping us make informed decisions. Without them, we were left piecing together information from various sources, which was both time-consuming and frustrating.

How Mortgage Maker Could Have Changed Everything

As we take a step back and reflect on our home buying experience, what’s clear that a mortgage lending SaaS platform such as Mortgage Maker could have transformed our home-buying journey. Mortgage Maker is a cutting-edge mortgage presentation software designed to help lenders provide their clients with the clarity and insights they need to make confident decisions. Here’s how it could have addressed our challenges:

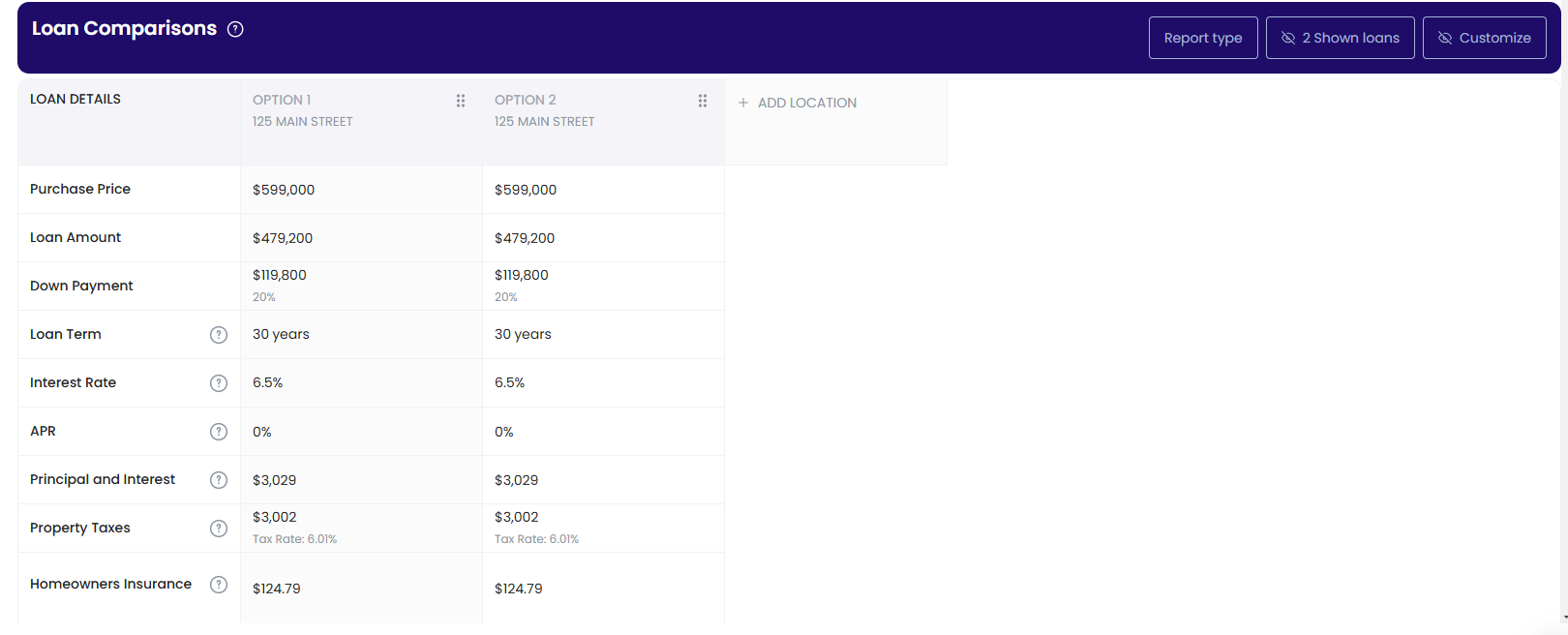

1. Comprehensive Custom Loan Comparisons

Mortgage Maker’s customizable loan comparison tool would have allowed our lender to create detailed, side-by-side analyses of different loan scenarios. With live property data and interactive insights, we could easily understand how changes in down payments or interest rates would impact our monthly payments and overall costs.

Mortgage Maker Loan Comparison Report

Mortgage Maker Loan Comparison Report

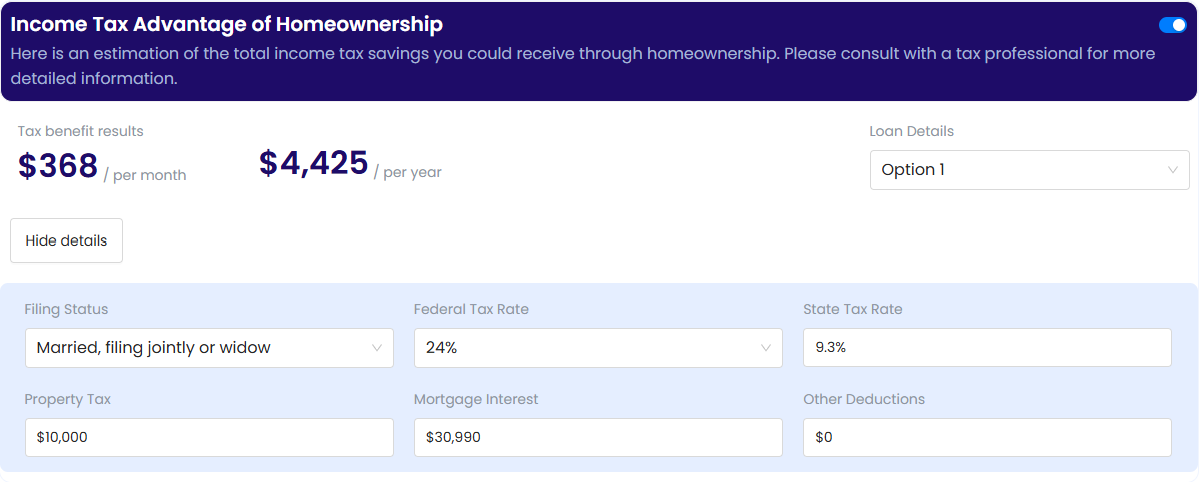

2. Clear Tax Advantage Visualizations

The Mortgage Maker platform’s ability to highlight the income tax advantages of homeownership could have saved us hours of research. Mortgage Maker’s professional, easy-to-read reports could have shown us exactly how buying a home could impact our taxes over time.

Mortgage Maker Income Tax Advantage of Homeownership Report

Mortgage Maker Income Tax Advantage of Homeownership Report

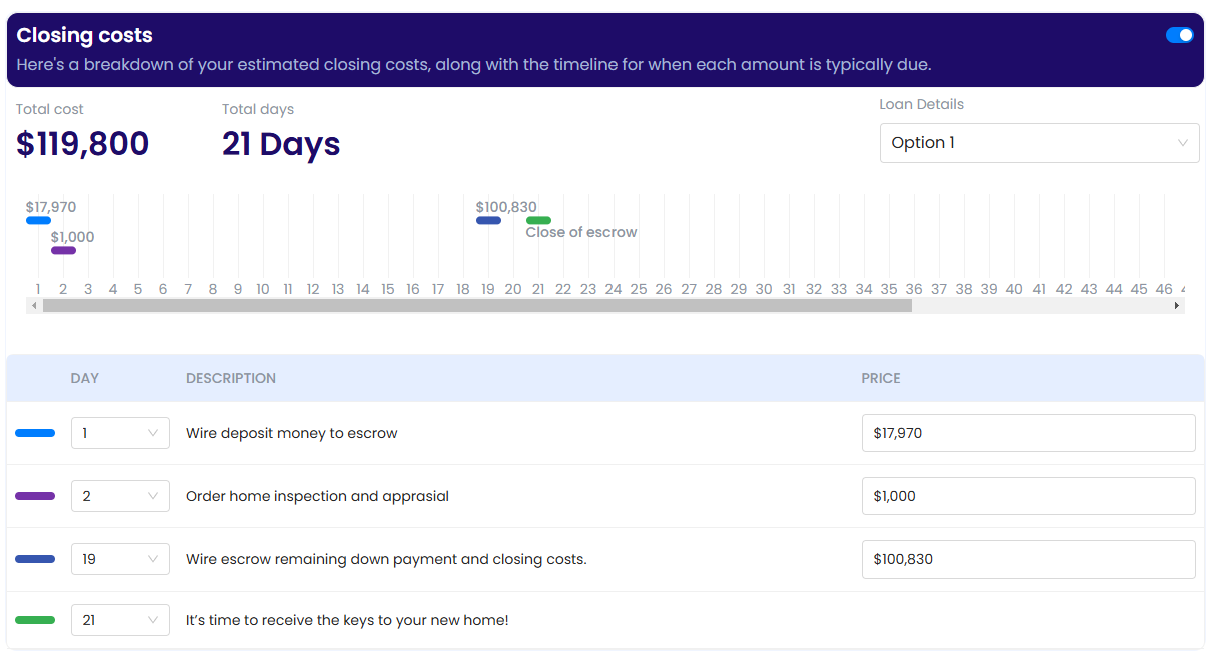

3. Closing Cost Transparency

Mortgage Maker’s tools for estimating closing costs with precision would have eliminated the guesswork. Having this information upfront would have made it easier to plan and budget, reducing our stress as we approached the closing date.

Mortgage Maker Closing Costs Report

Mortgage Maker Closing Costs Report

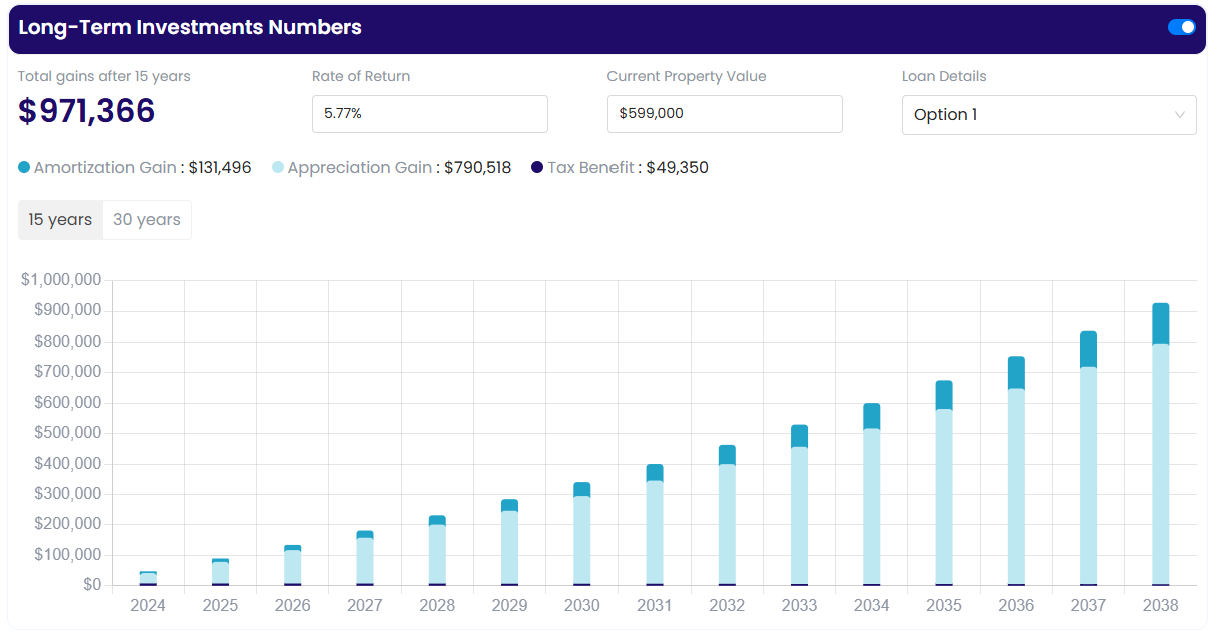

4. Long-Term Investment Analysis

With Mortgage Maker’s long-term investment forecasting, we could have seen projections for our property’s value over time. This would have given us confidence in our decision and helped us view our purchase as a strategic financial move.

Mortgage Maker Long-Term Investment Analysis Report

Mortgage Maker Long-Term Investment Analysis Report

A Suite of Essential Reports

Mortgage Maker also offers a variety of reports that would have been incredibly helpful, including:

- Break-even analysis for loan points

- Temporary interest rate buydown scenarios

- Renting vs. owning comparisons

- 15-year financial forecasts for renting vs. owning

Having access to these insights in a single, streamlined platform would have made the entire process more transparent and empowering and left us with more peace of mind we were making the right decisions.

Why Mortgage Lenders Should Embrace Tools Such As Mortgage Maker

For mortgage tech companies, tools like Mortgage Maker are setting a new standard for borrower homeownership education and mortgage rate strategy. By adopting this software, lenders can:

- Enhance client trust through clear and comprehensive communication

- Differentiate themselves in a competitive market

- Provide clients with actionable insights that foster smarter decision-making

- Close more deals

Mortgage Maker’s intuitive interface and robust features make it an indispensable tool for modern mortgage professionals.

Final Thoughts: Clarity Is Key to a Better Home-Buying Experience

Consider Adopting Mortgage Presentation Software Tools Like Mortgage Maker

While my girlfriend and I ultimately purchased our dream home, the mortgage process was far from ideal. The lack of clear documentation, comparative analyses, and long-term insights left us feeling overwhelmed and uncertain at times – conditions no buyer wants to experience. Tools like Mortgage Maker have the potential to revolutionize the home-buying experience by equipping borrowers with the information they need to make informed, confident decisions.

If you’re a mortgage lender looking to elevate your service and provide unparalleled value to your clients, it’s time to explore what Mortgage Maker can do for you. Learn more about this powerful mortgage presentation software at www.mortgagemaker.ai.