Maximizing Mortgage Success: Strategies for Lenders Amidst Holiday Market Dynamics

As the holiday season approaches, mortgage lenders may experience a slowdown in business due to seasonal factors. However, this period presents unique opportunities to refine strategies, engage potential buyers, and prepare for the upcoming year. We are here to help you strategize and ultimately close more deals, so the mortgage lending experts at Mortgage Maker developed a comprehensive overview of current market sentiments, economic indicators, and actionable insights to help accelerate lead generation and establish a client lead nurturing to optimize your mortgage lending practices.

Market Sentiment & Economic Calendar

The upcoming week is pivotal, with significant economic events that could influence mortgage rates and lending activities. Keep these dates on your radar and be sure to tune in to see how these leading economic indicators may affect mortgage lending rates, housing supply, and consumer demand in the days and months ahead:

- Tuesday, December 17:

- Retail Sales Data: The Commerce Department will release November’s retail sales figures. Economists anticipate a 0.5% increase, following a 0.4% rise in October, indicating continued consumer spending strength.

- Wednesday, December 18:

- Housing Starts and Building Permits: Data on new residential construction projects and permits issued will offer insights into the housing market’s momentum. How will you address a market upturn or decline?

- Federal Reserve Interest Rate Decision: The Federal Open Market Committee (FOMC) concludes its two-day meeting, with expectations of a 25 basis point rate cut—the third consecutive reduction. Investors and mortgage lenders will closely analyze the Fed’s statements for indications of future monetary policy direction.

- Thursday, December 19:

- Existing Home Sales: The National Association of Realtors will report on November’s sales of existing homes, with projections suggesting an increase to a seasonally adjusted annual rate of 4.01 million homes, following a rise in October.

Leveraging Boarder Income for Refinances

In scenarios where borrowers require additional income to qualify for refinancing, especially to remove a co-signer, boarder income can be a viable solution. FHA guidelines allow borrowers to use up to 30% of their total qualifying income from boarder payments, provided there’s sufficient documentation. This includes a written agreement with the boarder and evidence of consistent payments over the past year, such as canceled checks or bank statements. By incorporating this income, borrowers may achieve the necessary financial thresholds for approval. Keep this tip in mind as you are advising clients! Remember, any potential strategy you can implement that elevates you from the competition is an advantage.

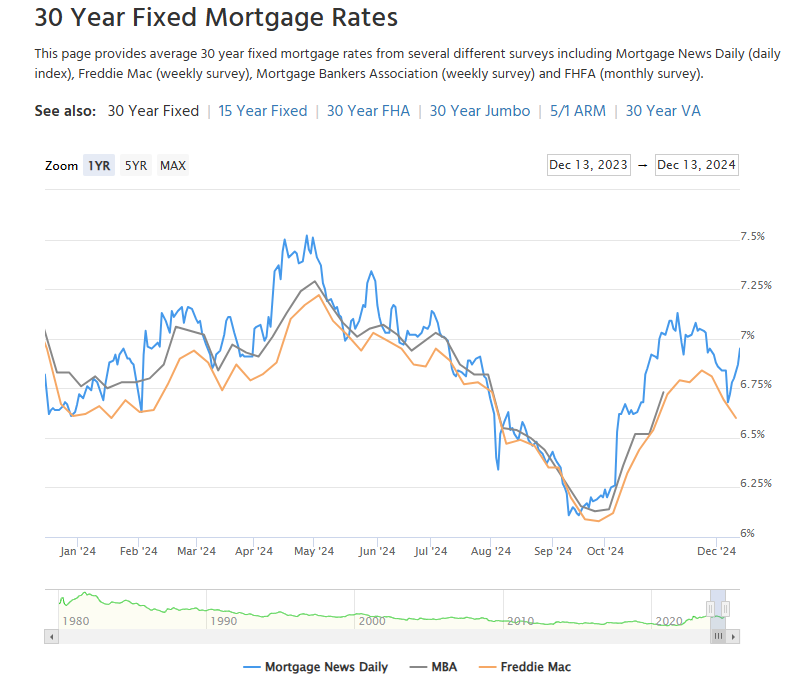

Interest Rate Fluctuations and Strategic Locking

In case you missed the news, recent months have witnessed significant volatility in mortgage rates. A decline to the low-6% range in September and October led to a surge in refinance activity, with over 300,000 mortgage holders closing refinance transactions—the highest level in more than two years. Notably, nearly half of these refinances were rate-and-term, with VA borrowers leading the trend by reducing their rates by an average of 1.28 percentage points.

However, rates rebounded swiftly, underscoring the importance of mortgage lenders advising clients to be prepared to lock in favorable rates promptly when opportunities arise. Additionally, with expectations of further rate reductions in the first and second quarters of 2025r, maintaining open communication with borrowers is important. Proactively discussing potential refinancing options can empower clients to capitalize on future rate decreases.

Source: Mortgage News Daily

The Debate on Displaying Mortgage Rates Online

The decision to publicly display mortgage rates on websites is a topic of ongoing debate among lenders largely because transparency can build trust and attract borrowers who value upfront information. Given that 95% of homebuyers begin their journey online, prominently displaying rates can enhance credibility and drive engagement.

However, mortgage rates are influenced by various factors, including leading economic indicators, credit scores, and loan types, leading to personalized rates for each borrower. Publicly posting rates may inadvertently lead to misunderstandings or enable competitors to undercut offerings. Moreover, rates are subject to rapid changes, potentially causing discrepancies between advertised and actual rates.

Mortgage lenders should weigh the benefits of transparency against the need for personalized service. Emphasizing the value of individualized consultations can shift the focus from merely obtaining the lowest rate to understanding the comprehensive benefits of working with a knowledgeable mortgage professional.

Actionable Steps for Mortgage Lenders

What’s knowledge without action? The Mortgage Maker team wants to help all lenders connect the dots between external market factors and your individual strategies. Here are some practical action steps you can take to help accelerate your pipeline growth and close more deals:

- Stay Informed on Economic Indicators: Monitor upcoming economic releases and Federal Reserve decisions to anticipate market movements and advise clients accordingly.

- Educate Borrowers on Income Qualification Strategies: Inform clients about options such as utilizing boarder income to enhance their refinancing prospects, ensuring they understand the documentation requirements.

- Act Swiftly in Volatile Rate Environments: Encourage borrowers to be prepared to lock in rates quickly during favorable conditions and maintain regular communication to keep them informed of market trends.

- Evaluate Online Rate Display Policies: Consider the implications of posting rates online and decide on a strategy that aligns with your brand’s values and client engagement approach.

- Leverage Technology: Utilize advanced mortgage presentation software to provide clients with clear, customized loan options, enhancing their decision-making experience and building trust.

By implementing these practical strategies, mortgage lenders can navigate the complexities of the current market, provide exceptional service to their clients, create positive competitor differentiation and position themselves for success in the evolving landscape of mortgage lending.