Top 5 Resolutions for Mortgage Lenders to Thrive in 2025

As we look ahead to 2025, the mortgage lending industry continues to face a shifting market characterized by fluctuating rates, evolving regulations, political influence, and increased client expectations. Mortgage lenders who want to thrive in this dynamic environment simply must adopt strategies that combine data-driven insights, advanced technology, and a client-focused approach. Customization, personalization, and relationship trust building continue to be strong themes in mortgage lending and we expect these themes to continue to resonate and proliferate with loan officers and mortgage bankers in 2025.

Listed below are the top five resolutions that every mortgage lender should have on their 2025 list to optimize operations, improve client outcomes (i.e. close more deals), and position themselves as trusted market leaders.

1. Develop a Winning Mortgage Rate Strategy

Understanding and predicting mortgage rate trends can be tricky and complicated but is essential for lenders who strive to provide optimal solutions. The Consumer Price Index (CPI), employment data, and Federal Reserve monetary policies are just a few leading economic indicators shaping the rate environment that should be evaluated and interpreted in the context of how it affects the mortgage lending market. For example, according to Mortgage News Daily, current mortgage rates have stabilized, but market volatility remains a factor as inflation continues to influence the Federal Reserve’s decisions.

How Mortgage Lenders Can Stay Ahead:

- Leverage platforms like Mortgage Maker AI for real-time rate tracking and scenario planning.

- Use predictive analytics to educate borrowers on potential rate shifts and guide them in how to lock optimal rates.

- Adopt a proactive approach to rate advisories, ensuring your borrowers make informed decisions.

2. Embrace Marketing Tools for Mortgage Loan Officers

Adopting digital marketing best practices remains a critical component of any mortgage lender’s strategy with the ones who get it right often holding a distinctive competitive advantage over their peers. In fact, it’s been proven that loan officers who understand and invest in customized digital marketing tools and campaigns are more likely to attract and convert quality leads. A comprehensive digital marketing presence is simply non-negotiable in 2025, especially as buyers increasingly research and connect online.

Best Practices:

- Utilize email marketing, social media ads, personal branding, and SEO-optimized content to capture audience attention.

- Platforms such as Loan Officer Hub offer mortgage lending resources, insights, and best practices to fine-tune your marketing strategies.

- *Mortgage Maker AI provides integrated tools that simplify personalized client communication, enabling loan officers to nurture leads efficiently.

(*want to trial the Mortgage Maker solution to create custom presentations for your clients? Click here to get started!)

3. Leverage Mortgage Automation Software

Efficiency is often called the “backbone” of modern lending practices. Mortgage automation software tools have slotted in to become indispensable for reducing manual tasks, customizing and sharing loan reports with live property data and interactive insights that generate more loan fundings. accelerating loan processing times and ensuring full compliance. One of the most distinctive advantages is that automation allows lenders to focus more on building relationships and less on repetitive workflows, an approach that meets and matches the shift to develop deeper. More meaningful and personal relationships with lenders.

Key Benefits of Automation:

- Streamlined processes for faster pre-approvals and closings.

- Accurate data management reduces errors and ensures compliance.

- The ability to develop deeper customer relationships based on trust and transparency.

- Mortgage Maker AI’s automation tools include customizable loan presentations and instant borrower insights, empowering lenders to stay competitive. Explore the platform.

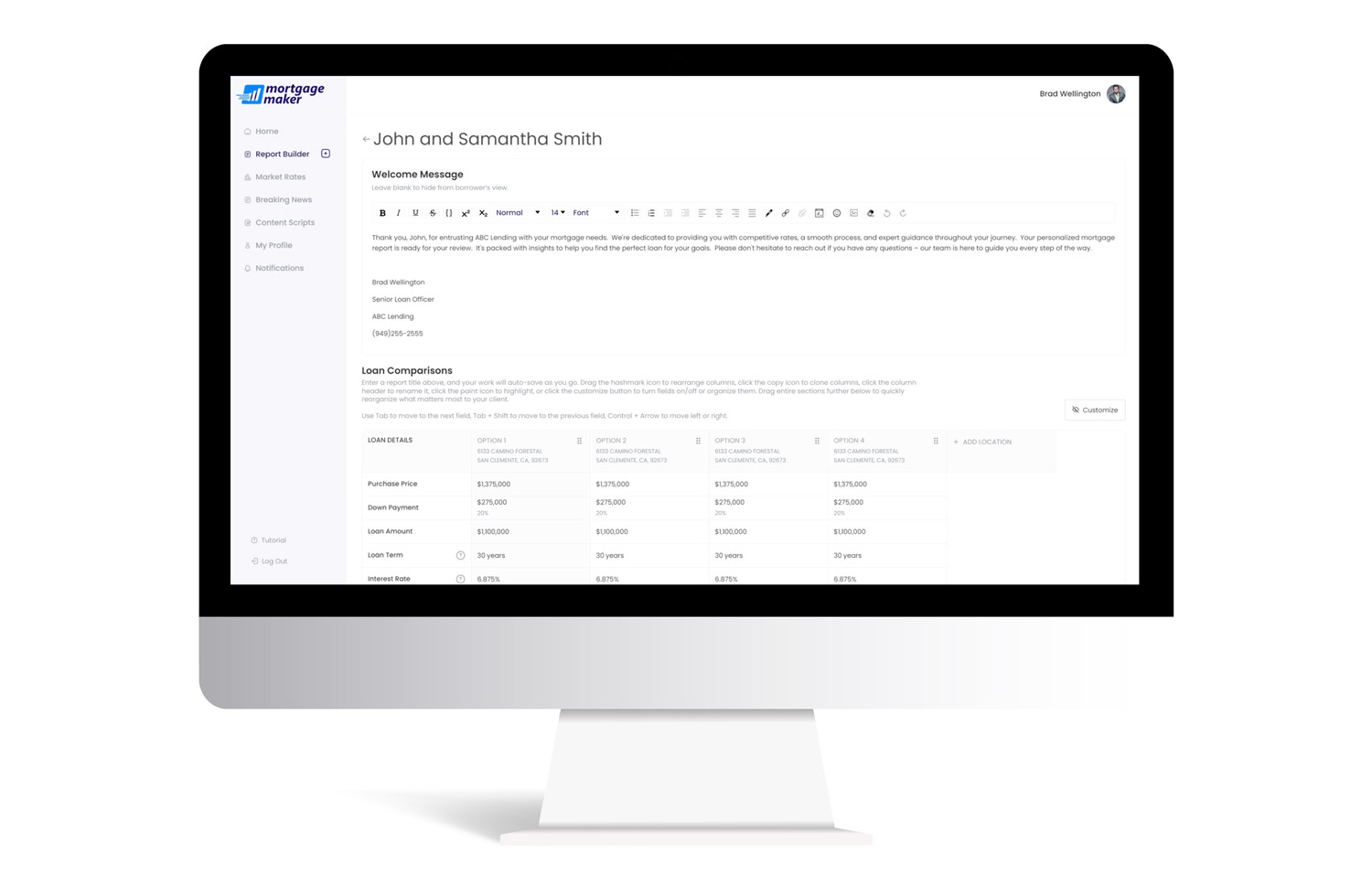

4. Utilize Mortgage Presentation Software for Client Engagement

More than any time in the history of purchasing a home, clients value clarity and transparency during the loan process. No one wants unplanned surprises or access to data and information that is confusing and unactionable. Mortgage presentation software helps lenders deliver clear, interactive loan options, building trust and confidence that deepens relationships. Tools like these are pivotal in transforming the borrower experience.

Actionable Tips:

- Create interactive, scenario-based loan presentations to help borrowers visualize multiple scenarios and options.

- Ensure reports are mobile-friendly, concise, clear, and meaningful as more clients rely on digital devices for decision-making.

- Incorporate tools like Mortgage Maker AI for real-time adjustments and polished, co-branded presentations that resonate with clients and offer actionable intelligence.

5. Stay Data-Driven with Market Insights

To maintain an edge, mortgage lenders must regularly analyze economic data and market trends. Resources like HousingWire and Fannie Mae provide invaluable insights into factors affecting the housing market.

How to Leverage Data:

- Monitor indicators like the GDP, CPI, and housing inventory levels to anticipate market shifts.

- Use data analytics tools to identify borrower trends and adjust strategies accordingly.

- Regularly review compliance updates from sources such as the Consumer Financial Protection Bureau to stay aligned with industry standards.

Position Yourself for Mortgage Loan Success in 2025

As if the volatility of the past 4 years hasn’t been enough, we believe that the mortgage industry is poised for even more transformation in 2025. By adopting these five resolutions, mortgage lenders can improve operational efficiency, strengthen client relationships, and remain competitive in a dynamic market.

Ready to take your mortgage lending strategies to the next level? Discover how Mortgage Maker AI can help you streamline processes, deliver personalized client experiences, and stay ahead of industry trends. Start your free trial today.