“…it feels like going from a BlackBerry to an iPhone – the speed and efficiency are that big of a leap…”

Vs. 30-45 mins with legacy tools

When viewed within 24 hours

Works on any device, anywhere

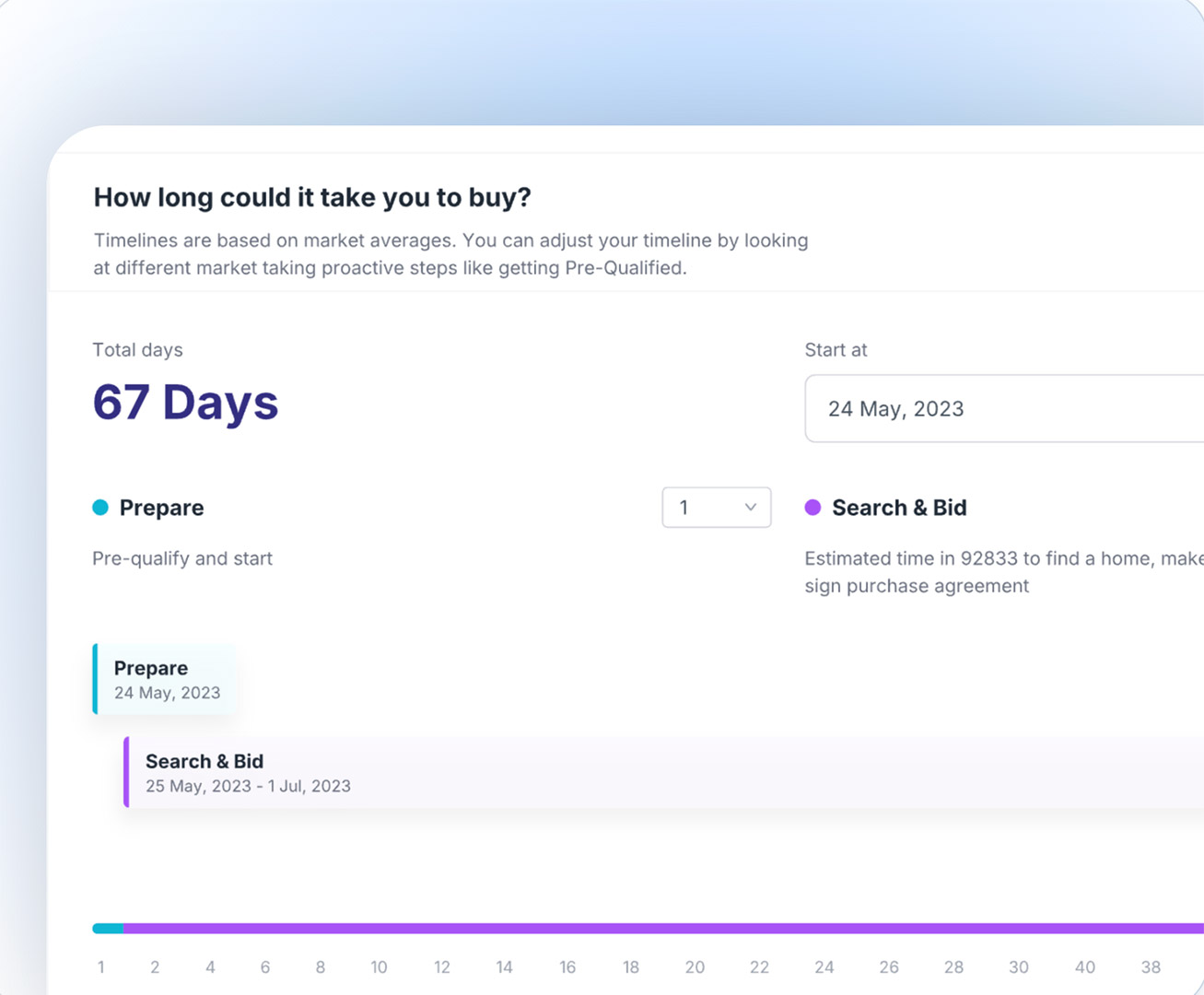

Older mortgage presentation software can slow you down. Confusing interfaces, manual data entry, and static PDF reports waste valuable time. Many loan officers spend 20–30 minutes navigating through multiple screens just to create a single comparison. That’s time you could be using to serve clients and build relationships.

$150–$300 per month

$200–$350 per month

$79 per month (billed annually)

Timelines and ranges reflect typical implementations and may vary by scope.

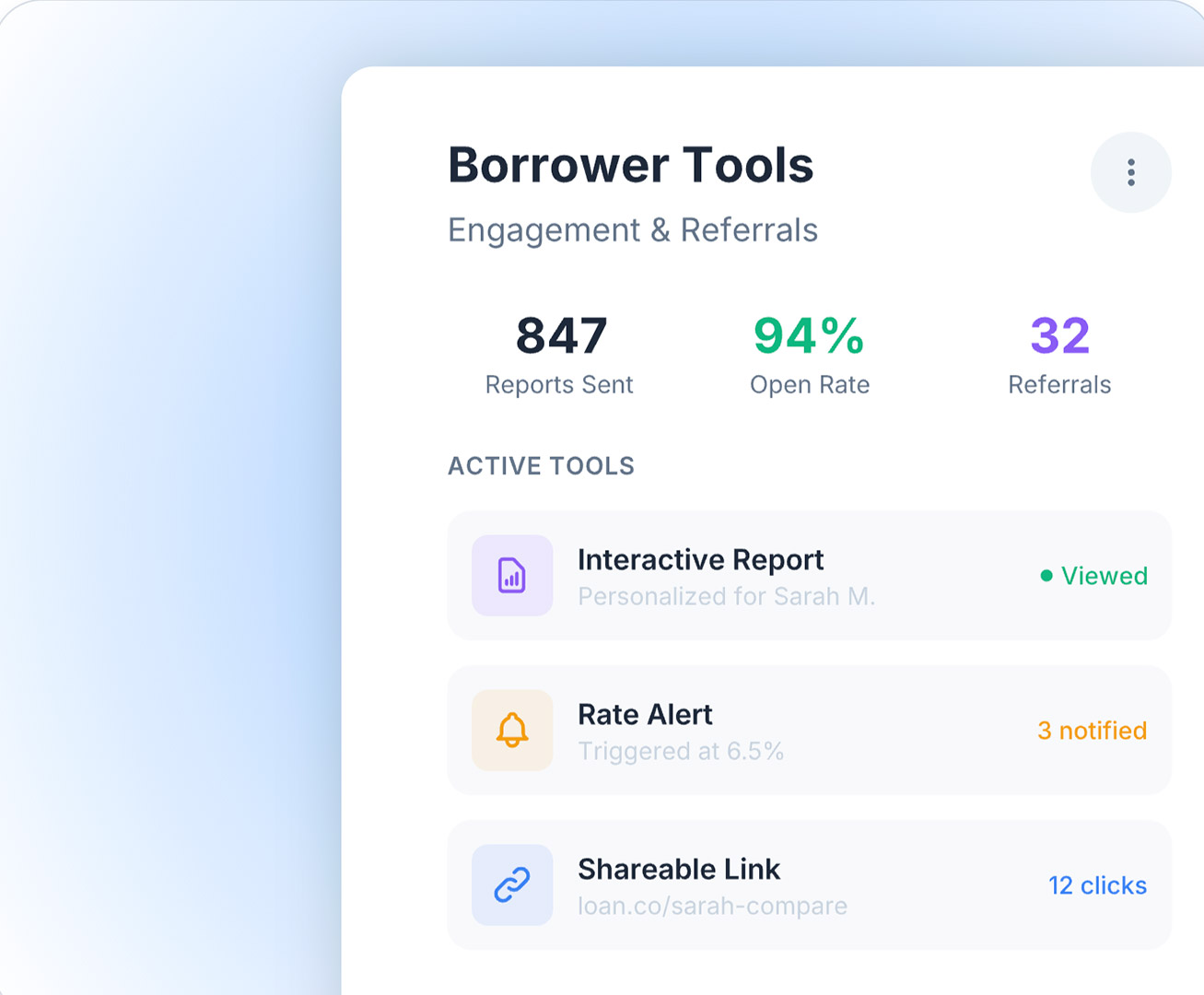

This is where “modern” becomes measurable: faster builds, clearer decisions, stronger trust.

Mortgage Maker is built for the reality of your day: fast changes, quick follow-ups, constant “can you show me what it looks like if…”

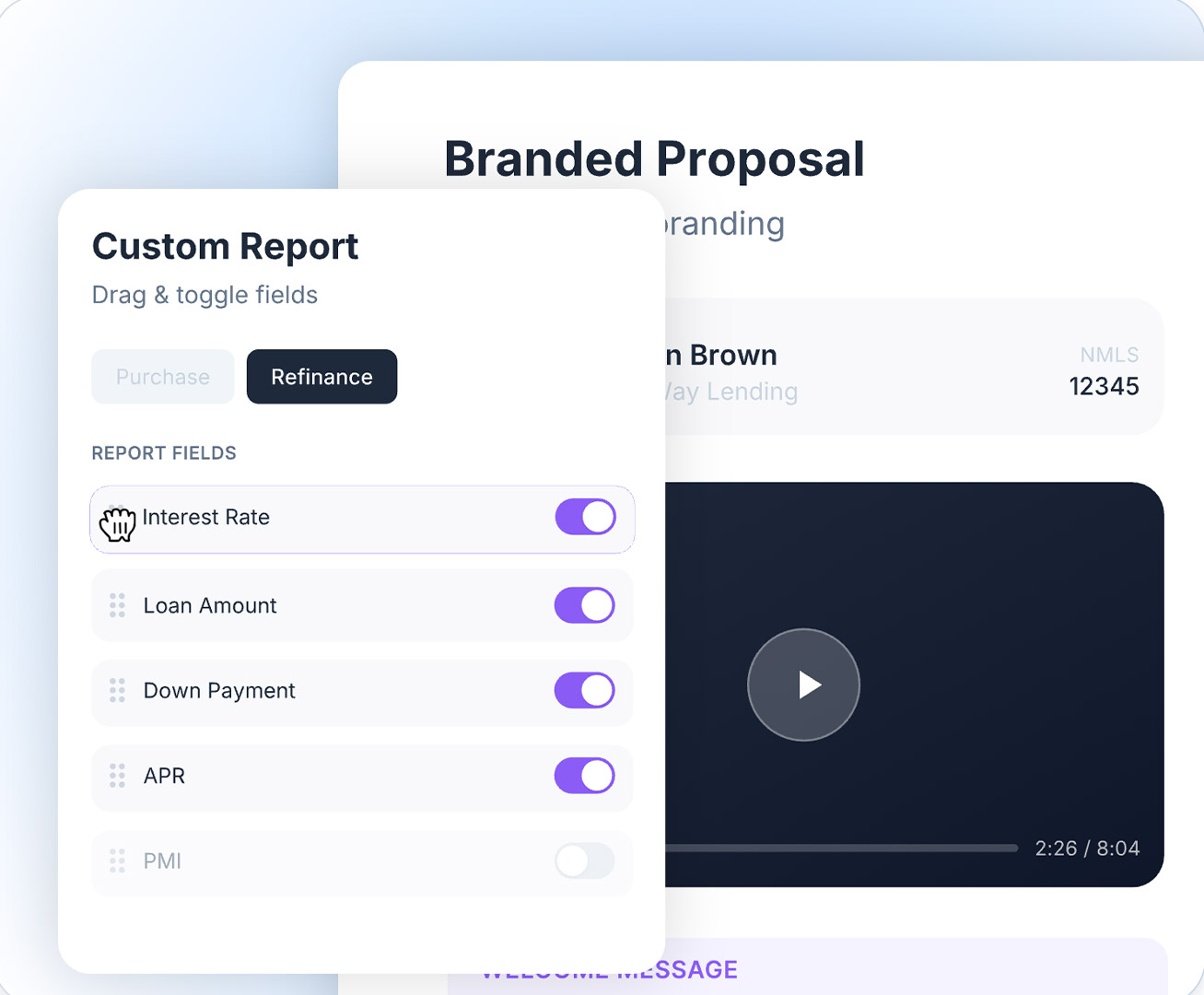

Borrowers don’t want a wall of numbers. They want confidence.

Mortgage Maker helps you present options with:

This is a major difference-maker: not just sending numbers—sending a guided experience.

With Mortgage Maker you can:

You shouldn’t need weeks of training to produce a compliant, professional presentation.

Everything Modern Loan Officers Should Demand

Built by LOs, for LOs. We know what closes deals.

Encrypted data transmission (SSL/TLS).

Secure cloud infrastructure.

Syncs seamlessly with Encompass & ICE.

US-based help when you need it. 7 days a week.

If you want a tool that’s modern, LO-friendly, borrower-friendly, and built for fast custom presentations—Mortgage Maker is built for you.